Sam Altman Returns to OpenAI 🤖 Binance CEO Resigns ❌ Nvidia Revenue Triples 📈

It was announced last week that Sam Altman, co-founder and now again CEO of OpenAI, will return to the company just a week after the board forced him out.

Sam Altman Returns to OpenAI

Binance CEO Resigns

Nvidia Revenue Triples

Holiday Shopping Season Begins

Sam Altman Returns to OpenAI 🤖

It was announced last week that Sam Altman, co-founder and now again CEO of OpenAI, will return to the company just one week after the board forced him out.

OpenAI said last Tuesday that it has an agreement in principle for Altman to re-join alongside an almost entirely new board, which will replace the one that forced him out.

Most of OpenAI’s investors seem to be pleased about Altman’s return and believe that it’s in the company’s best interest to keep him in the CEO role.

The whole process, from firing to reinstatement as CEO, lasted 5 days but the rationale for his firing still remains unclear.

The Guardian and Reuters reported that part of the reason the board ousted Altman was their concern over a new model known as Q*.

Q* can reportedly solve problems it hasn’t seen before, a key step on the path towards Artificial General Intelligence (AGI) - a breakthrough that many experts worry isn’t as far away as the general public believes.

Binance CEO Resigns ❌

Binance CEO, Changpeng Zhao, otherwise known as CZ, has stepped down from the company and pleaded guilty to violating US money laundering laws.

Prosecutors alleged that Binance encouraged users to hide their location so the company could avoid violating anti-monetary laundering laws.

He founded Binance in July 2017 and led it to become the largest crypto exchange in the world

Binance pled guilty and agreed to pay a fine of $4.3 billion. Zhao himself will pay $50 million subject to separate civil penalties he’s agreed to pay.

In a post on X, he said “I made mistakes, and I must take responsibility. This is best for our community, for Binance, and for myself.”

Binance users took out more than $1 billion from the exchange in the 24 hours after the ruling and liquidity dropped 25%. BNB, Binance’s native token, fell more than 8%.

Despite this, the platform still holds around $65 billion of crypto and has avoided a mass exodus.

Nor has the ruling had a massive impact on crypto prices, other than BNB, most cryptos remain more or less where they were before the ruling.

This could actually end up being be positive news for the crypto industry. With the case now in the background and the possible approval of a Bitcoin/Ether ETF, the future might be better than some had feared for the broader crypto industry.

Nvidia Revenue Triples ⬆️

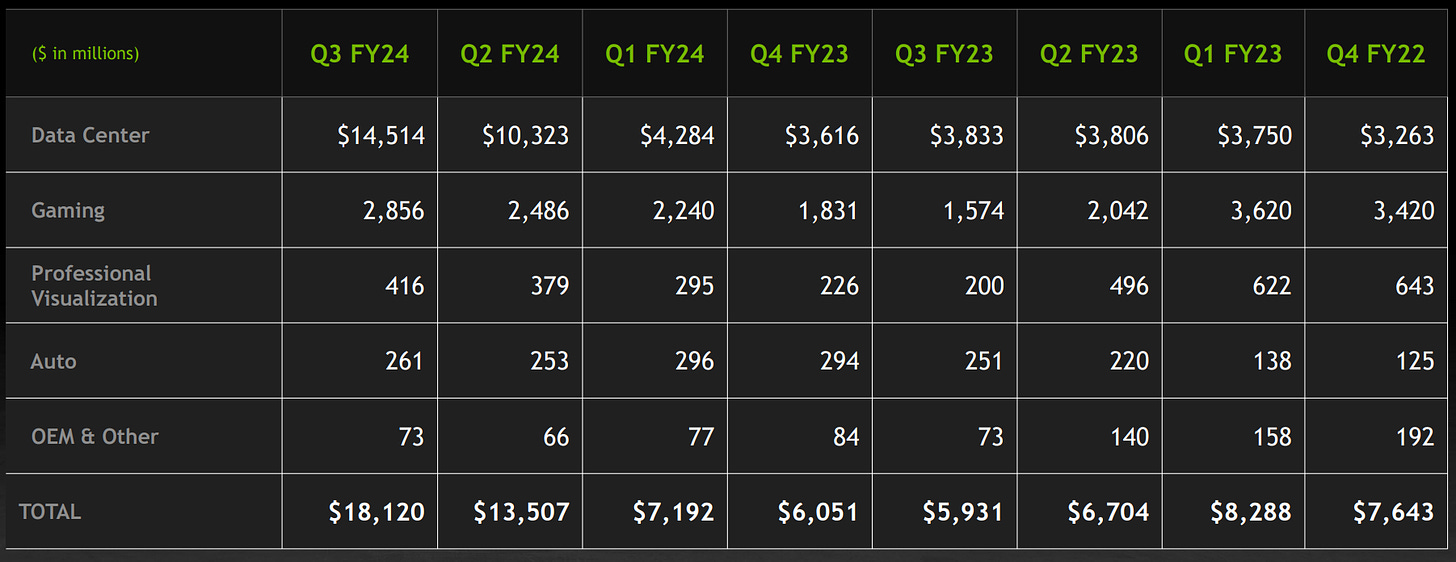

Nvidia’s third quarter results beat expectations but the company said that export restrictions would affect sales in China during Q4.

Total Revenue: $18.1 billion vs $16.2 billion expected, 206% up year on year.

Data Centre Revenue: $14.5 billion.

Gaming Revenue: $2.9 billion.

Earnings per share: $4.02 vs $3.37 expected.

Net income (profit) was $9.24 billion, up from $680 million during Q3 2022.

Revenue from its data centre business was particularly robust, largely thanks to the ongoing generative AI boom that started around this time last year with the release of ChatGPT.

Speaking about the results, Jensen Huang, Nvidia CEO said “Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI.”

The company has said it plans to develop new products to comply with US government regulations which limit the power of chips that can be exported to China.

Despite these restrictions limiting exports, Nvidia has said it believes demand from other countries would more than offset the fall in revenue.

Nvidia said it expects to make around $20 billion in revenue in Q4, which would be roughly a 230% growth rate compared to Q4 last year.

Nvidia stock is up 188% in 2023.

Holiday Shopping Season Begins

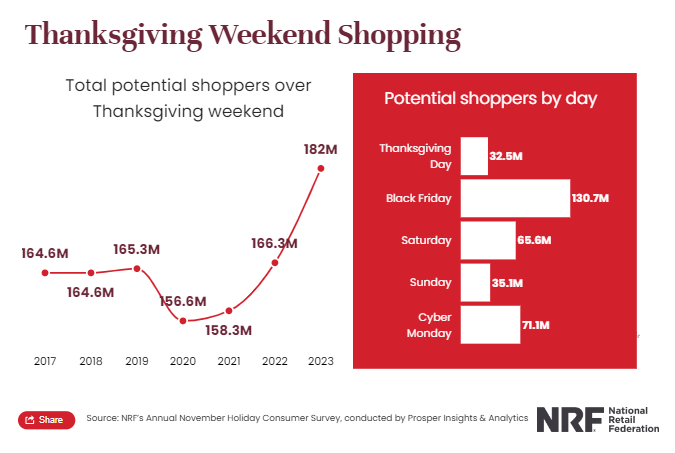

A record number of people are expected to turn out for the start of the holiday season in the US.

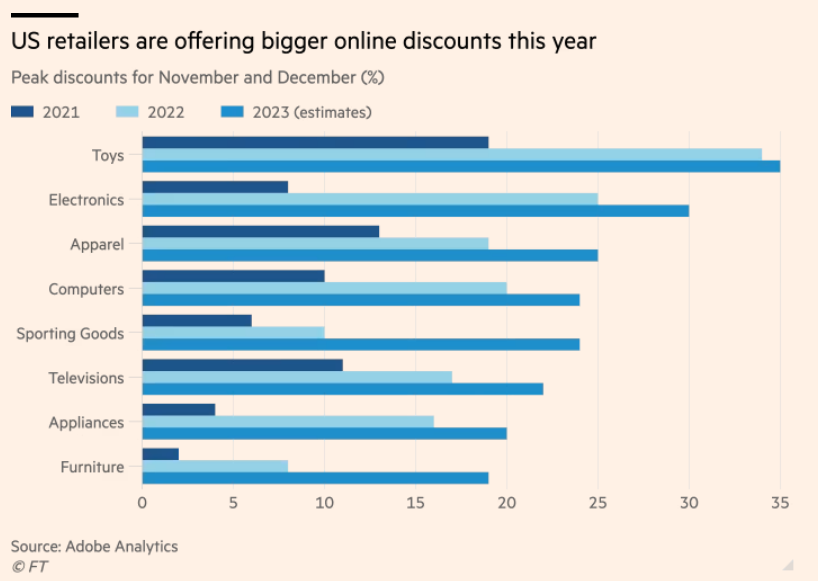

Black Friday (the day after Thanksgiving) kicked off the shopping season last week with many retailers touting steeper discounts than normal.

The National Retail Federation (NRF) expects 182 million people to shop in store and online from Thanksgiving to Cyber Monday (November 23rd - today) this year, 15.7 million more than last year.

According to Deloitte, the average spend will be 13% higher than last year at $567 per person.

Retailers have been offering higher than normal discounts in a bid to get consumers to spend more. More shoppers, especially the younger ones, are also expected to take advantage of buy now pay later services (BNPL).

All this comes after a year in which consumers have surprised many analysts with their resilience to higher prices and willingness to spend amid higher inflation.

Analytics from Adobe suggest that shoppers spent $5.5 billion on Thanksgiving, an all time high and it’s thought that online shopping on Black Friday hit about $9.6 billion, up 6% from last year.

We’ll soon see just how resilient the US consumer is once the actual data for the festive period is released.