The Rise of Buy Now Pay Later Services: A Convenient Solution or a Debt Trap?

Arguably the biggest development in consumer shopping habits in the past few years is the emergence of "buy now, pay later" payment options. But what are they, and why are they so popular? 🤔

Buy now pay later (BNPL) payment options allow you to divide the cost of a purchase into manageable installments over a set period, typically without any accompanying interest or charges. Its surging popularity, particularly among millennials and Gen Z, can be attributed to its convenience, affordability, and flexibility.

In this article, we’ll explore the ins and outs of BNPL as well as future trends, and the arguments for/against this popular payment scheme.

The Basics of Buy Now Pay Later

BNPL has quickly become a shopper's favorite payment option. Instead of paying the entire amount upfront, customers can spread the cost and avoid the financial burden of a large one-time payment.

Part of the attractiveness of BNPL lies in its flexibility. The number of installments and payment frequency are tailored to the buyer. Whether you need to pay off your purchase in two payments or twelve (although it’s typically four), BNPL offers the freedom to choose.

Whilst most BNPL providers don’t impose interest charges on purchases, a few do. The interest rates are dependent upon the specific provider and the duration of the payment term. You might incur late fees and other charges if you miss a payment or fail to pay the entire sum by the end of the payment term.

BNPL means that expensive purchases can be more affordable. Customers can now acquire goods and services that would have been beyond their financial reach by dividing the cost into several payments. It’s viewed by many as a hassle-free solution for shoppers requiring a swift purchase but needing more immediate funds - this is largely what accounts for its rising popularity.

The Popularity of Buy Now Pay Later Services

BNPL services have been hugely popular with millennials and Gen Z. In 2020, PYMNTS.com found that 39% of millennials and 44% of Gen Z’ers have used BNPL services.

The recent COVID-19 pandemic has also helped fuel demand. The growth in remote working has meant a shift towards online shopping, and the demand for flexible payment options has grown. Juniper Research expects the BNPL market to reach $995 billion in transaction value by 2026 and have more than 1.5 billion users, up from 340 million in 2021.

Investors have also taken note of the burgeoning BNPL industry. Klarna, perhaps the best-known BNPL company, grew the value of its US sales by 71% in 2022 compared to 2021. Although the company’s valuations plunged in 2022, along with all other tech stocks, at its last fundraiser in July of 2022, investors valued it at 3x its 2018 valuation, and in 2021, it was valued at 17x.

The attention from investors indicates the potential for continuing growth and innovation in the BNPL space.

The Risks of Buy Now Pay Later

Although BNPL has advantages over traditional buying, it comes with risks. Perhaps the most substantial and obvious is racking up debt. If you use BNPL to purchase goods and services beyond your means, you could end up paying back unmanageable amounts of money.

Another peril of BNPL is the likelihood of exorbitant interest rates and fees. While some providers abstain from imposing interest, others do, and these can be very steep.

Suppose you miss a payment or fail to settle the entire amount by the end of the payment term. You’ll end up paying late fees and additional charges. It’s paramount to understand the terms and conditions of the BNPL agreement before signing up.

BNPL can influence your credit score. If you default or miss a payment, it might adversely impact your creditworthiness. Certain providers report BNPL activity to credit bureaus.

It's crucial that customers stay aware of payment deadlines, avoid late payments, and shun late fees at all costs.

Government Regulations and Industry Oversight

With the rise of BNPL services, governments and industry are sitting up and taking note.

In the UK, the Financial Conduct Authority (FCA) announced in February 2023 that it would put regulations governing BNPL services in place. These regulations would mean that:

“Lenders offering BNPL products would need to be authorised by the financial regulator and would need to comply with various regulatory requirements and consumer credit rules”

In September 2022 in the US, the Consumer Financial Protection Bureau (CFPB) issued a report saying that BNPL companies must be subject to stricter oversight, similar to those that regulate credit card companies. The report also said they harvest data in ways that threaten consumer privacy - yet another ethical concern they raise.

Ethical Considerations for Buy Now Pay Later Services

It’s not only customers accumulating debts, there’s other concerns related to the use of BNPL platforms.

One being the marketing practices of some BNPL providers, which many believe can be misleading or deceptive. Although some providers advertise their services interest-free, customers may still be liable for fees and penalties for missed payments. This isn’t always made clear however when the customer sign up to the program.

BNPL services' impact on vulnerable or low-income customers is another significant ethical issue. While these services offer flexible payment options, money-strapped individuals may be susceptible to accumulating debt they cannot afford to repay.

And as mentioned before, the collection and handling of customer data by BNPL providers has sparked concerns about privacy and data security. As the information gathered is often personal and confidential, safeguarding it and ensuring its responsible usage is crucial.

The Future of Buy Now Pay Later

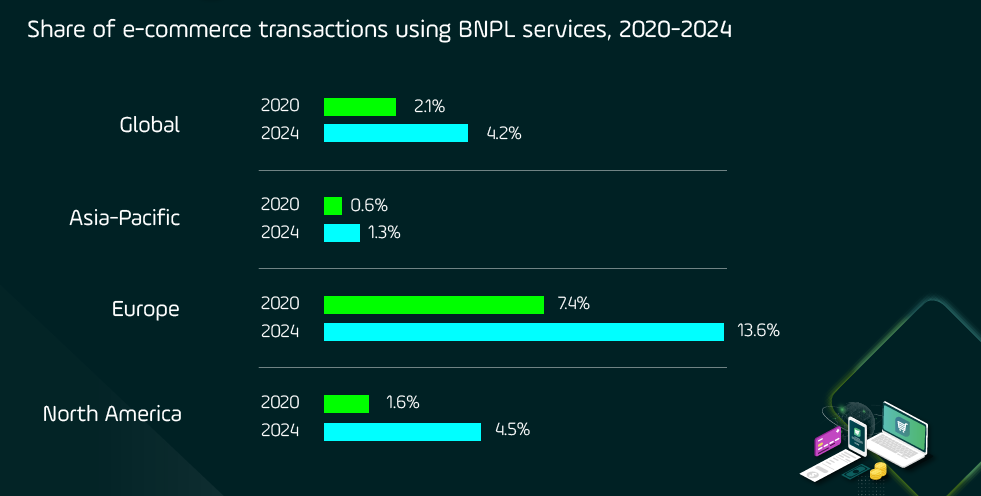

BNPL has experienced a surge in demand since the pandemic, and its set to grow even more in the coming years. Several factors will fuel the growth, including the growing use of digital payments, surging e-commerce sales, and ever-evolving consumer conduct.

BNPL is branching out to new domains and territories. Besides its conventional application in retail, it’s also finding uses in travel, healthcare, and education. The approach is gaining impetus in emerging markets, such as India and Latin America, where cash rules the roost, although digital payment alternatives are progressively sprouting up.

Nonetheless, the rise of BNPL also poses regulatory hurdles and ethical deliberations. In certain nations like the UK and Australia, regulators are scrutinizing BNPL providers and their modus operandi to ensure consumer safety. Data confidentiality and security loom as pivotal concerns, given the amount and potential uses of the customer information that BNPL providers collect and retain.

Final Thoughts

The rise of BNPL as a preferred payment option has offered customers a flexible, affordable, and convenient way to shop. While BNPL can prove advantageous to consumers and retailers, it’s not without risks, and anyone using it should exercise caution.

BNPL clearly has a bright future, with ample growth opportunities in new industries and developing markets. Yet, regulatory hurdles and ethical concerns must be addressed to ensure transparent and responsible operations by BNPL providers. As with any financial service, customers should stay informed and assess whether BNPL aligns with their payment preferences and goals.