Big Tech: Unstoppable & Evolving⚙️

Reports of big tech’s demise have been greatly exaggerated.

Turn on Bloomberg, CNBC or open any investing website and you’ll often be inundated with analyst opinions about why the big tech companies are soon to fail and their share prices along with them. Such articles were still being published in 2022, a year in which many would argue they were at their most reasonable valuation ever.

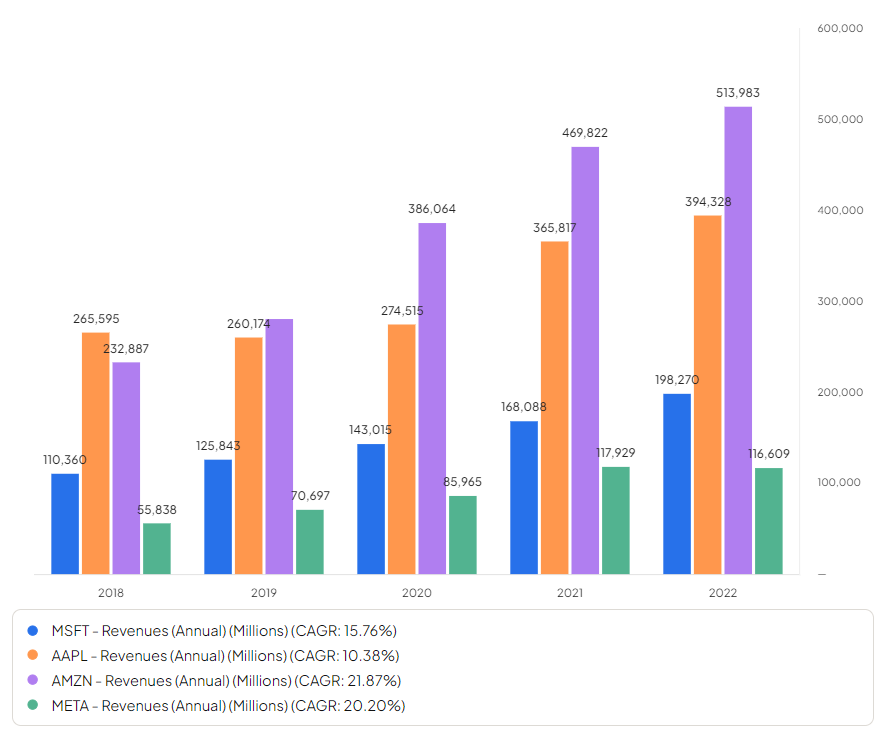

Yet despite this, since 2015, the big tech companies have grown at an astonishing rate. If you’d invested in a basket of them rather than listening to a financial advisor and being “diversified”, you would very likely have beaten most hedge fund managers and put in a lot less work.

Global Reach

The reach and scale of the big tech companies has been pivotal to their enduring market dominance. Unlike traditional brick and mortar businesses, their digital-centric models allow them to cross borders and leads to rapid expansion into different markets. This is particularly true in software companies like Facebook and Google, whose services are used worldwide, always in a similar manner.

Such a global presence not only bolsters their market influence but also provides them with a wealth of user data, enabling better targeting of products and services to specific demographics. The scalability of their business models means they can efficiently manage their increasing user base without proportional cost increases. Both of these make it much much harder for start-ups competing against them.

Business Models and Necessity

Many of these companies have also evolved far beyond their original scopes, adapting to market needs and becoming the main providers of new technologies in the process. Amazon expanded from online retail to dominate cloud computing with AWS (along with Google and Microsoft), and Facebook famously grew from humble beginnings as a college social network to dominate the industry pretty much everywhere except China.

This adaptability is key to their role, not just in technology but in economic stability. In the West, they have a huge influence on the labour force and stock markets, while in China, counterparts like Alibaba focus on domestic markets and government alignment.

The integration of the tech they provide into everyday life and business operations underscores their indispensability to governments and other companies alike.

Services like smartphones, social media, e-commerce, and cloud computing, once luxuries, are now essential and deeply embedded into the modern world. Amazon Web Services is a prime example, providing critical infrastructure to organizations from Netflix to the CIA.

As these companies venture into new areas like AI, they are set to increasingly influence the global economy and society at large.

Risks to Big Tech

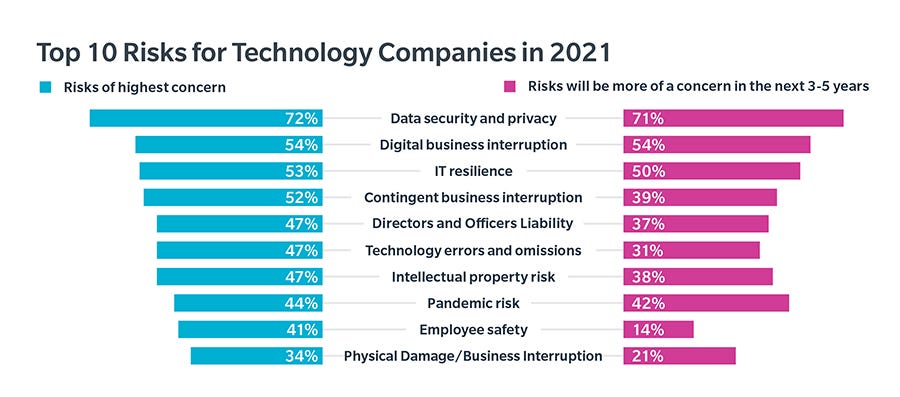

The growth of big tech companies, while impressive, faces several risks. One of the primary concerns is regulatory scrutiny. As these companies grow in size and influence, they attract more attention from government regulators concerned about antitrust issues, data privacy, and market monopolies.

The scrutiny could lead to stringent regulations, hefty fines, or even the forced breakup of these companies, as seen with major corporations in the past. The global push for stricter data privacy laws, such as the GDPR in Europe, poses challenges to the business models of companies that rely heavily on user data.

There's also the challenge of innovation stagnation, a problem which Peter Thiel makes convincingly about Google. To maintain their edge, the big tech companies need to continually innovate, but as they grow larger, maintaining this pace of innovation becomes more challenging.

There's also the risk of a loss of consumer trust due to issues like data breaches or misuse of information, which could lead to a decline in the number of users and impact their growth and profitability.

Risks like these have been around for almost the entire existence of the big tech companies however and there’s little reason to believe they will succumb to them in a big way anytime soon given their size and importance.

Future

The current big tech companies will continue their trajectory of influence and innovation, albeit amidst an evolving landscape of challenges and opportunities. Other companies have joined them from the original FAANG (Facebook, Apple, Amazon, Netflix, Google) acronym first coined in 2013 by Jim Cramer. It’s now often referred to as the Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla).

The advancement of new technologies like generative AI and quantum computing presents new frontiers for growth. These companies, with their substantial resources and research capabilities, are well-positioned to lead in these areas, potentially revolutionizing sectors like healthcare, transportation, and communication.

The increasing digitalization of the global economy, accelerated by the pandemic, suggests a growing reliance on the services and infrastructures provided by these tech giants. This trend points towards a future where big tech's role in our daily lives and the broader economy becomes even more pronounced.

Whether you like it or not, their decisions and directions will continue to impact the global economy, societal norms, and everyday life. While their path is fraught with regulatory, competitive, and ethical challenges, their ability to adapt and innovate will likely continue to make them central players in shaping our world.

It's true that the Big Tech has amassed enormous power. Will the government try to tame them like they did to Microsoft at the end of 1990s?