Whatever Happened to NFTs?

$25 billion of NFTs were sold in 2021 a 250X increase over 2020. But since then the demand for them has collapsed - What’s happened and will they ever make a comeback?

Despite first being conceived in 2014, it wasn’t until 2021 that NFTs (Non-Fungible Tokens) really became mainstream.

They were tipped to be the next big thing, and by the end of 2021, about $25 billion worth of them had been traded.

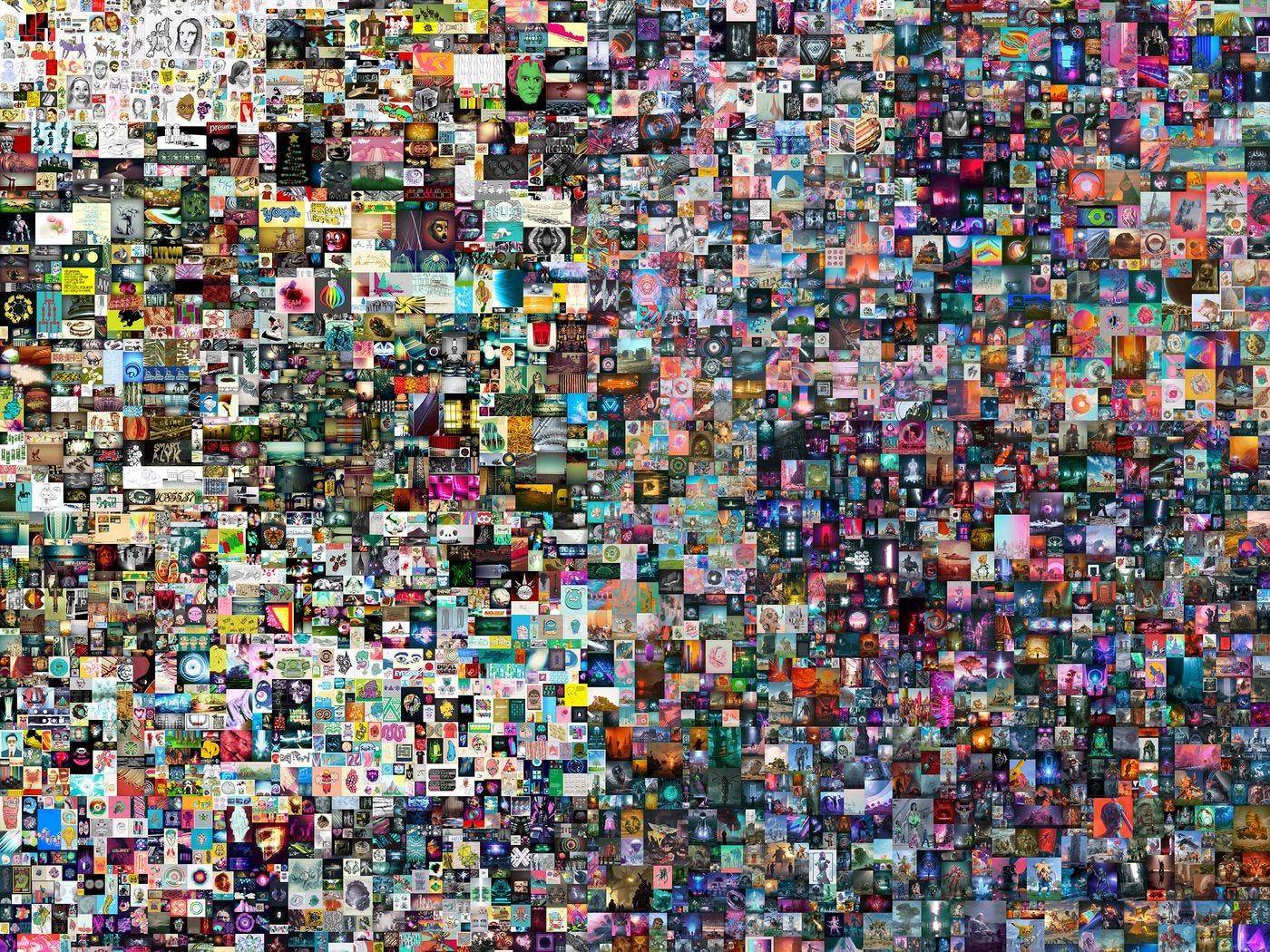

Many of the most popular, including the infamous BAYC (Bored Ape Yacht Club) collection sold for way over $1 million each.

2022 also started off well… but then crypto crashed and took the NFT market with it.

The Hype

At the start of the NFT hype cycle, there was hope that they would herald a new era of data sovereignty. Artists could prevent their creations from being stolen and anyone could prove ownership of any digital asset they wanted (or could afford).

They were all over the news with people like Jake Paul and Justin Bieber minting their own NFTs. Unfortunately, as with so much in the crypto/NFT space, Jake Paul’s turned out to largely be a scam.

2021 was hailed as the year when NFTS moved away from being niche entities and were embraced by the masses. Even TechCrunch said the NFT industry is “just getting started.”

It was the Collins Dictionary word of the year and was searched for more than Dogecoin, blockchain, and Ethereum.

People were spending large portions of their life savings to buy them and brands from Coke to Microsoft were even entering the space.

So where and why did it all go wrong?

The Collapse

The collapse of the NFT market was almost as quick as its rise.

In April of 2022, Reuters published an article saying “The NFT bubble isn't popping, but it may have sprung a leak.”

Surprisingly, there were actually more NFTs sold in 2022 than in 2021 (101 million in 2022 vs 58.6 million in 2021) and the value of all NFTs sold was similar.

But it was the second half of 2022 when NFT sales really tanked.

The start of 2022 was promising. OpenSea (which used to be the primary platform for trading NFTs) alone registered $5 billion in trading volume in January. Unfortunately, by June that had fallen to $1 billion.

Sales started slowing and enthusiasm for the digital tokens waned. The collapse of LUNA in May and FTX towards the end of the year certainly didn’t help, but in hindsight, perhaps NFTs were always doomed to fail.

“What’s different about this specific burst, unlike other market fallouts, is that there was really no specific event that was a catalyst triggering a major downfall” - Felix Shipkevich, fintech regulatory attorney.

So what’s next for this once booming industry?

What’s Next?

Unfortunately for the NFT community, there doesn’t seem to be many signs of resurgence in 2023.

At the start of June, there was a slight uptick in NFT trading volume but it later became clear that that was a result of issues affecting a range of NFT projects.

The platforms people used to buy NFTs have also had their own issues. Blur has overtaken OpenSea as the platform of choice for most NFT buyers. This comes with its own set of concerns, with Blur even asking its users to stop using OpenSea back in February.

Using the blockchain to buy images of apes so you “own” them certainly wasn’t the intention of people like Vitalik Buterin, who created Ethereum with the aim of it someday becoming the world’s computer.

It also seems like a huge waste of money and talent to have had people working on NFT development, so I for one am glad to see that the hype around NFTs has shrunk.

That’s not to say that they can’t make a comeback, but it seems unlikely given the collapse and their infamous reputation.

Hopefully, now Web3 builders can get back to focusing on its core ideas - decentralization and data sovereignty.