Starbucks announces its NFT program, SBF is finally arrested, and Moderna's cancer breakthrough. Newsletter #2

19/12/2022

In This Issue:

Starbucks announces it’ll begin an NFT-based loyalty program.

SBF arrested in the Bahamas.

Interest rate rises start to slow around the world.

Moderna’s cancer vaccine breakthrough.

Tesla tumbles on Musk’s Twitter antics.

Starbucks and its new NFT loyalty programme.

Starbucks recently launched a new loyalty programme; the only difference is that this one’s NFT-based.

Known as “Starbucks Odyssey” the new loyalty scheme was released to a small waitlist in the US in early December and allows participants to embark on “journeys”. According to Starbucks, these journeys will consist of “entertaining, interactive activities to earn collectible ‘Journey Stamps’ (NFTs) and Odyssey Points that will unlock access to exciting new benefits and experiences”.

The idea was inspired by a promotion called “Starbucks for Life” where users would earn stickers for spending money at Starbucks and playing mini-games in the Starbucks app. The more they spend - the more they earn. The Odyssey programme is similar, but rewards users with digital collectibles for playing and spending money rather than stickers.

Adam Brotman, co-founder of Web3 consultancy firm, Forum3, and former Chief Digital Officer at Starbucks, worked closely with them to create the programme. He says examples of journeys include “going to a Starbucks store you’ve never been to this week or trying a Starbucks drink you’ve never tried”.

Upon completion of a journey, users will be rewarded within an NFT known as a “stamp” with a points value. Users can trade these collectibles on a secondary market built into the Odyssey platform. You can even win prizes such as a trip to a Costa Rican coffee farm or access to an online coffee-making class.

It’s exciting to see big corporations adopt Web3 technologies (other well-known companies experimenting in the Web3 space include Nike, TIME Magazine, and Samsung). It would be cool to see them try to use the technology in a way that gives power back to the consumer - one of the key themes of Web3 is decentralization, taking control out of the hands of large corporations and governments. But this is unlikely to happen for obvious reasons.

Even if they are using the technology in a centralized format, it’s still cool to imagine how it might be used in the future. NFTs could allow a company’s biggest fans access to special events or unique merch. They could allow fans special access to their favourite music artists or even allow users to vote on company policies or product development.

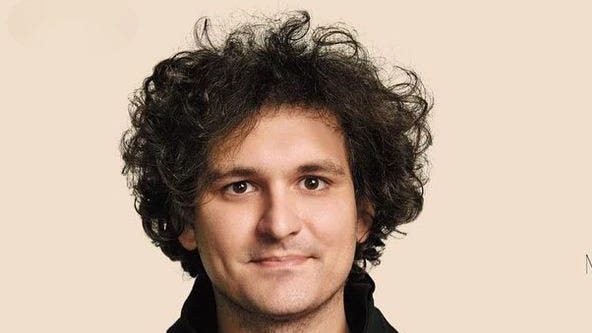

SBF Arrested and Charged by the SEC

Sam Bankman-Fried, the CEO of now bankrupt crypto exchange, FTX, was finally arrested in The Bahamas on 12 December. It came after the local government received news from the US administration that it would seek his extradition back to the US to stand trial.

SBF, who was once lauded by the media as the “J.P. Morgan of crypto”, has been charged by the Securities and Exchange Commission (SEC) with defrauding investors and campaign finance fraud (perhaps unsurprisingly, he donated a lot to politicians in the US) and was denied bail after a judge in The Bahamas claimed he was too much of a flight risk.

FTX filed for bankruptcy on 11 November after users withdrew funds from the company en masse following a report by CoinDesk that said most of its assets were held in its native token, FTT, which had little actual value.

The company has been accused of a "complete failure of corporate controls", with the investigator into the case saying, “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.” A Manhattan attorney called it “one of the biggest financial frauds in American history.”

Some are saying the arrest might signal the bottom of the crypto market. I think it’s too soon to say, but I certainly hope so! The rise of the crypto market soon after the arrest was promising, but unfortunately, it’s fallen since. Regardless of the short-term crypto moves, much like Mt Gox in 2014, the fallout from this should hopefully serve to make the crypto market more regulated and more appealing to investors in the long run.

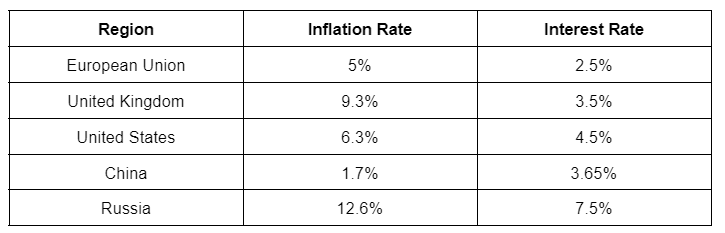

Interest rate rises start to slow

As inflation starts to fall worldwide, central banks are set to enter a new phase of slowing interest rate increases. Policymakers are signalling that they plan to continue to raise rates to bring inflation back to its pre-covid levels, just at a slower pace than they have been doing.

In the western world, inflation remains well above the target level of 2% but is expected to fall significantly next year. The US, EU, and UK all raised their rates by 0.5% last week, lower than the recent increases of 0.75% but still significantly higher than the 0% or 0.25% increases that have been prevalent for much of the last decade.

The Fed announced the 0.5% rate increase on Wednesday; stocks sold off heavily the next day; the S&P 500 and Nasdaq fell 2.5% and 3.2% respectively.

The latter of last week was a bad one for US equities, and for tech especially. Tech companies generally do well in times of low-interest rates, so the recent increases won’t help them rebound in the last two weeks of the year.

I think rates will fall next year, along with inflation. But I think it’s unlikely they’ll fall back to 2% until 2024 at the earliest. Once they do come back down to near 2%, tech stocks should start to do well again.

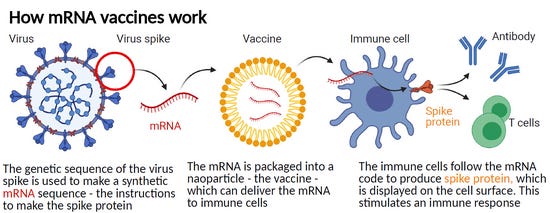

Moderna Stock Rockets on Positive News from its Cancer Trial

Shares of Moderna shot up 24% on Tuesday last week after it announced positive results from a phase 2 study evaluating the use of a messenger RNA (mRNA) vaccine combined with Keytruda as a treatment for stage 3/4 Melanoma. Despite the jump, shares are still down roughly 16% for the year but

Moderna and Merck, Moderna’s partner in the study, reported that the personalized mRNA vaccine + Keytruda reduced the risk of recurrence or death by 44% compared to Keytruda alone. Serious side effects were also relatively low, occurring in just 14% of patients.

The study was the first randomized clinical trial to show that a personalized mRNA vaccine can effectively treat cancer. It also paves the way for personalized cancer treatments for forms of cancer other than melanoma.

Moderna and Merck expect to begin a phase 3 study using the vaccine for the treatment of melanoma next year and publish complete data from the phase 2 study sometime in the next few months.

It’s the latest breakthrough in melanoma treatment which has had a renaissance in the last decade with a range of new and effective treatments. Hopefully, it can also be applied to other forms of cancer whilst remaining just as effective.

It’s another boost for Moderna, one of the first companies to develop a Covid vaccine and is leading the mRNA cancer vaccine charge.

Although the mRNA technology is best known for its use in the Covid vaccines, it also holds a lot of promise in the treatment of cancer. Unlike chemotherapy which can’t distinguish between cancer and non-cancer cells and destroys both indiscriminately, mRNA vaccines teach the body's immune system to target the tumor.

Unfortunately, personalized mRNA vaccines are extremely expensive, and it’s still going to be a few years until they become a standard of care treatment, but this is a promising development. From what I’ve read though, this seems to be just one more step on the road to super-effective cancer treatments that, by 2030, could mean that cancer is no longer viewed as the death sentence that many see it as today.

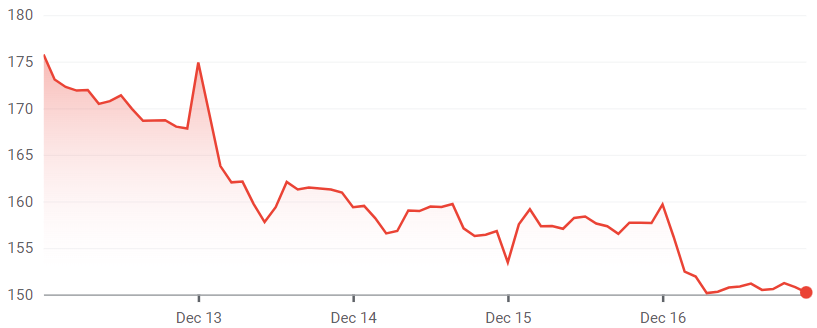

Elon Musk Hurts Tesla Investors with his Tweeting

Tesla fell early last week as the broader market rose. Elon Musk’s tweeting is becoming a distraction from the larger story; the success of America’s leading eclectic vehicle company.

As a Tesla investor, it’s becoming quite annoying to see the price of the company so dependent upon the whims of its CEO.

It was revealed on Wednesday that Musk had sold $3.6 billion of Tesla stock, taking his total sold this year to nearly $40 billion! It’s not clear that this is related to his acquisition of Twitter, but it doesn’t inspire confidence in the company.

Investors' main worry is that he’s not focusing on the business and instead is becoming more concerned with defeating “the woke mind virus”; doing so could take his focus away from Tesla.

According to Reuters, Musk’s stake in Tesla is 13.4% as of December 15, 2022, significantly lower than the 17% of shares he held at the same time last year. Tesla remains the most valuable car company in the world but sits at its lowest level since November 2020 and is down 61% since the start of the year (and by 28% since he bought Twitter on October 27).

I love the company so I’m not too worried about the price action this year, but I wish he’d get off Twitter and focus more on Tesla and SpaceX!

Interesting Articles/Videos:

Higher Education in the Metaverse: https://nftnow.com/features/college-in-the-metaverse-is-the-world-ready-for-metaversities

How Cryptocurrency is Changing Life for University Students: https://www.publish0x.com/bitcoin-news-blog-bitcoin-dice-casino-news/how-cryptocurrency-is-changing-life-for-college-students-xpzymxz

When will fusion be ready: https://www.wsj.com/articles/when-will-fusion-be-ready-for-prime-time-watch-these-three-numbers-11671159158

It’s time to pay attention to AI:

The Full SBF and FTX Saga: