Twitter goes crazy over ChatGPT, BIS finds an $80 trillion "blindspot", and Coinbase revenue plummets. Newsletter #1

12/12/22

In This Issue:

BIS says there’s an $80 trillion “blindspot” in the global economy.

Tech Twitter goes crazy over ChatGPT.

Nigeria tries to get more people to use crypto.

US unemployment rate set to surpass 5.5% next year.

Coinbase revenue set to plummet.

The $80 trillion FX Blindspot

The Bank for International Settlements (BIS) announced in a 7 page report that pension funds and other “non-bank” financial firms have over $80 trillion of off-balance sheet dollar debt in foreign exchange (FX) swaps.

The US Federal Reserve normally uses currency swaps to calm the market, as it did in 2008 and in 2020 at the start of the pandemic. However, this “off-sheet” debt is missed by standard debt statistics, making it harder for policymakers and analysts to anticipate how it might affect the global financial system. It also makes it difficult for them to try and act in the midst of a crisis when they’re unsure how their actions will affect the economy.

The BIS said most of the missing dollar debt is outside of the US, in institutions that borrow US dollars to hedge against the investments they make in their local currencies. The US dollar is the reserve currency of the world meaning there’s no need for a foreign bank to exchange its dollar reserves to allow for it to make global transactions.

Holding dollars reduces exchange rate risk. This isn’t simple to explain but here’s an explanation that goes deeper into the dollar and its role as a reserve currency.

On a more positive note the BIS did also say that the market disruption that’s occurred this year has been navigated well by central banks and there haven’t been any major issues so far. Hopefully it’ll stay this way next year!

ChatGPT

OpenAI, the AI company founded by Elon Musk and others in 2015, released ChatGPT at the end of November. Since its release, it’s had over 1 million sign ups and led to plenty of funny and interesting interactions.

OpenAI is well-known for having built the text-to-image generator DALL-E and GPT3 (with the supposedly even more impressive GPT4 rumored to be set for release early next year).

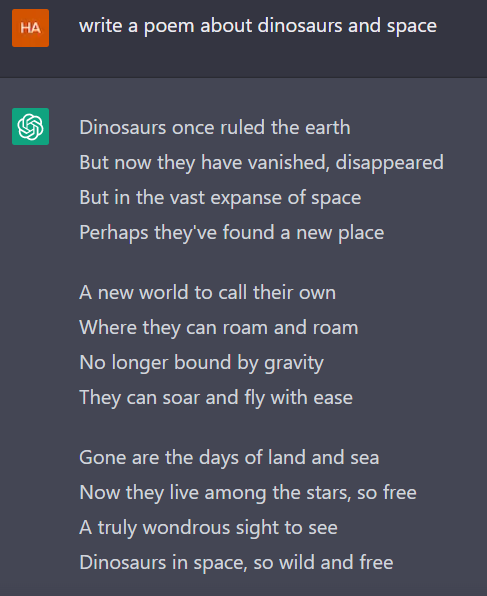

It is their new chatbot, and in my opinion, they’ve done a pretty amazing job. After receiving a prompt, the bot can write code, create business plans, play text-based games, and talk about almost anything. It still has issues that often lead to funny results. But it’s incredibly impressive when it does work. It doesn’t have access to data later than 2021 so can’t answer questions about recent news.

ChatGPT is trained on huge amounts of text data that have allowed it to understand the patterns and structure contained in human language. It uses something called reinforcement learning, where a program learns the correct answer to an input through its own experience rather than being told the answer by a human.

It still doesn’t understand the meaning of what it’s saying, but it does a very good job of giving that impression (the Chinese Room Experiment gives a clearer understanding of this concept).

I asked it: “What is your purpose?”

It replied: “As a large language model trained by OpenAI, my purpose is to assist with a wide range of tasks, such as answering questions, providing information, and generating text. I can provide helpful and accurate information on a wide range of topics, but my responses are limited to the knowledge and training that I have received. My primary goal is to be helpful and provide accurate information to the best of my ability.”

There are plenty of interesting, funny, and mind-blowing conversations people have had with the AI online. Topics include chess, poetry, cooking, and law. People have even used it in their job already.

Some have even suggested it may replace Google in the not too distant future. Personally I think it needs to be quicker and should cite its sources before it can do so, but I can easily see it doing so sometime in the next few years. They are even significant updates coming to the software before Christmas.

It’s available now for anyone to try out!

Nigeria Limits Cash Withdrawals in an Attempt to Boost its CBDC

Nigeria has limited cash withdrawals to $45 per day in a bid to encourage the use of its Central Bank Digital Currency (CBDC), the eNaira, named after Nigeria’s local currency, the Naira. It’s the government's latest attempt to try to get more people to go cashless.

Less than 0.5% of Nigerians are thought to be using the eNaira. Nigeria’s Banking Supervision Department has said that more people “should be encouraged to use alternative channels (internet banking, mobile banking apps, USSD cards/POS, eNaira, etc.) to conduct their banking transactions.”

Despite the low figure using the country’s CBDC (and the supposed “ban” on the use of crypto), around 25% - 50% of Nigerians are thought to be holding or actively trading cryptocurrencies.

CBDCs have become more popular in recent years as a way to improve the safety and efficiency of payment systems. They do go against one of the cornerstones of the Web3 movement however - decentralization.

US Unemployment Will Likely Surpass 5.5%

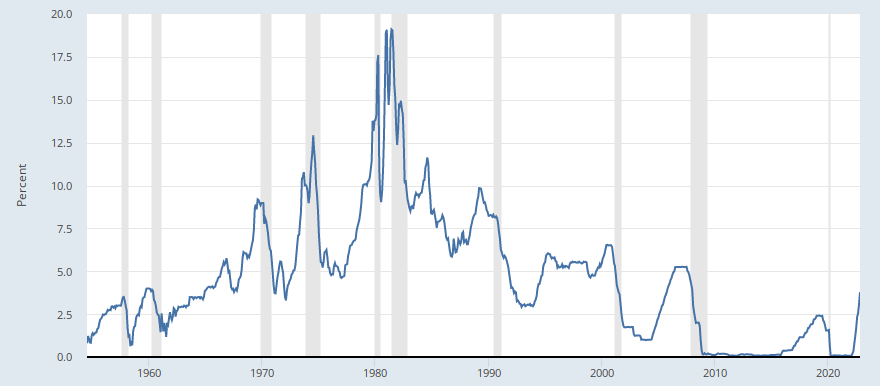

The Federal Reserve’s attempts at eliminating high inflation will raise the US unemployment rate above 5.5% and push the US economy into a recession (2 consecutive quarters of negative growth). That’s according to a poll conducted by the Financial Times on leading economists.

Thankfully, the economists also expect the recession to be short and that the economy will still grow by 1% over the whole year. Most economists expect the US interest rate to reach 5% (it’s currently at 3.75%) as the Fed continues to try and tame the high inflation created by the Ukraine conflict and the fallout from the pandemic. It’s usual target is an inflation rate of 2% but it currently stands at 8%.

Analysts also expect the US housing market to slump next year as the wider economy does shrink; it’s already started to slow due to skyrocketing mortgage rates. Some are even predicting house prices could fall by as much as 10%!

It’s important the Fed gets the balance right between increasing interest rates to bring down inflation, but not increasing them enough to prevent companies borrowing money and slowing down the economy.

Stock returns and year to year economic growth aren’t as closely related as is often believed so even if the US does enter a recession next year, it doesn’t necessarily mean that US stock returns will be low (thankfully!).

Coinbase Revenue Set To plunge

Coinbase’s revenue this year will be less than 50% of 2021’s, according to CEO, Brian Armstrong. The primary drivers of this are the ongoing crypto winter and the collapse of FTX damaging faith in centralized exchanges. 2021 revenue was $7.8 billion.

Speaking on Bloomberg TV, he said “this year, with everything coming down, it’s looking, you know, about roughly half that or less”. Coinbase’s share price is already down 83.5% this year and this news is unlikely to help the company.

Armstrong also said that he expects clearer regulation of the crypto world to emerge in the US next year.

Compared to much of the media, he’s been highly critical of Sam Bankman-Fried (SBF), former FTX CEO. Earlier in December, he spoke out about the FTX scandal, saying SBF used “stolen customer money in his hedge fund”.

The fallout from the FTX scandal is ongoing and it’s still not exactly clear what the long-term fallout from it will be. Hopefully, it will lead to further transparency amongst exchanges or an increase in the number of people holding their crypto off exchanges.

Interesting Articles/Videos:

Pros/Cons of Brands Being Involved in Web3: https://www.coindesk.com/layer2/2022/12/02/brands-will-save-crypto-be-careful-what-you-wish-for

Why we need a replacement for fiat (government-issued) money: https://blockworks.co/news/how-broken-monetary-policy-fuels-instability

How this year has changed passive income with crypto: https://www.publish0x.com/johnwege/my-crypto-passive-income-strategy-has-changed-xjrqqyo?a=M7e57XKAb2

The Full SBF and FTX Fraud Saga (1hr 18mins):

ChatGPT: The Next Level in Conversational AI. (4 mins)