The UK proposes a new digital currency, Google shows off Bard, and will the SEC crackdown on crypto staking? Newsletter #10

Bank of England aims for a digital currency by 2030

Google fights back against Microsoft

SEC cracks down on crypto staking

Things to watch in the markets this week

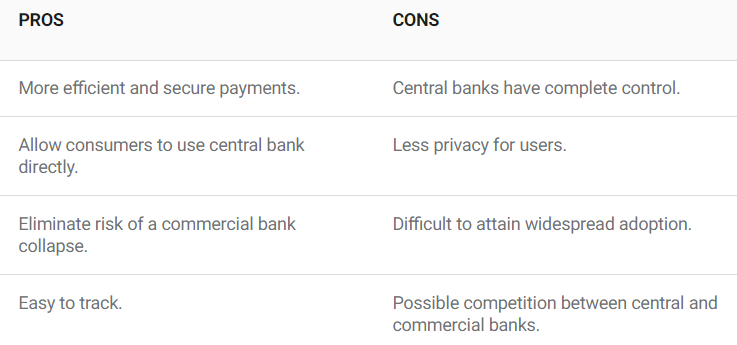

The UK’s new Central Bank Digital Currency (CBDC)

The Bank of England and the UK treasury announced plans for the creation of a digital pound, which some have dubbed “Britcoin”. This is the latest development in the ever-changing world of Central Bank Digital Currencies (CBDCs) which have been growing in popularity since about 2019.

The new digital pound could replace banknotes by the end of this decade, and would help the BoE fend off the potential threat of a private company creating a digital currency that could replace the pound.

A final decision over whether to create the currency will take place as soon as 2025, although its use likely won’t begin until 2030.

The BoE says the digital pound would replace cash and be controlled by the bank but accessed via wallets from third-party companies. According to them:

“The digital pound would not be a cryptocurrency or cryptoasset. As opposed to cryptocurrencies, which are issued privately, the digital pound would be issued by the Bank of England and be backed by the Government.”

The official paper for the project claims that:

“A digital pound would help to ensure that central bank money remains available and useful in an ever more digital economy, continuing to bolster UK monetary and financial stability while safeguarding the UK’s monetary sovereignty in a changing global financial system.

It could provide a platform for private sector innovation, promoting further choice, competition, efficiency and innovation in payments. It could also have further benefits for the resilience and functionality of payments in the UK.”

Some believe that CBDCs are a solution in search of a problem. The private sector already has an effective infrastructure for payments and very rarely do people have any problems paying for anything either with cash or digitally.

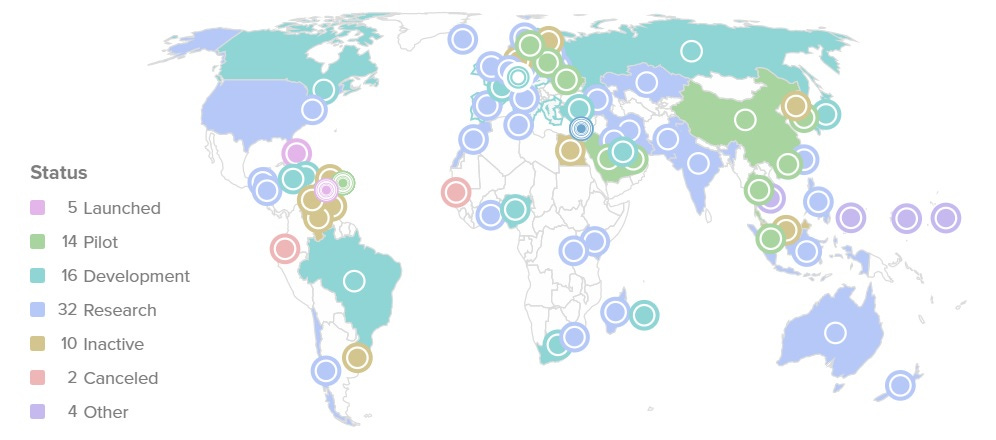

CBDCs are growing in popularity nonetheless and it’s thought that around 114 countries are exploring CBDCs at the moment, including the EU.

Google fights back against Microsoft

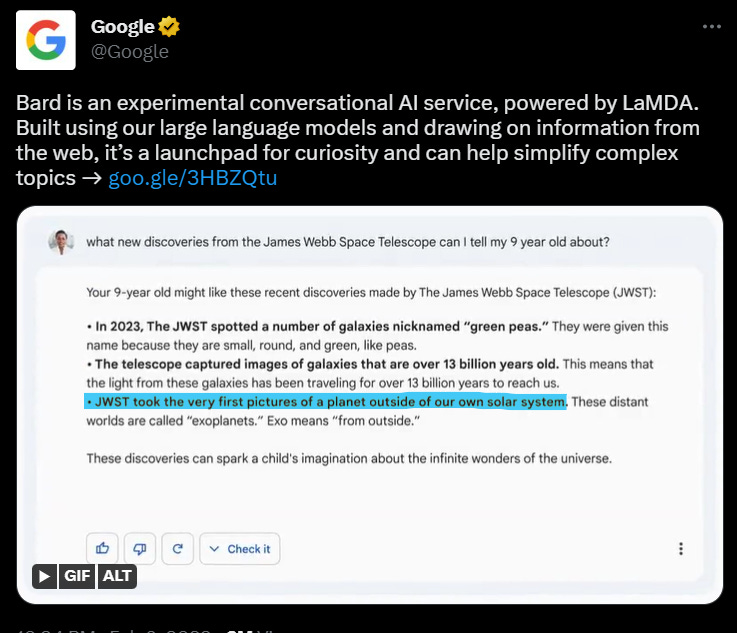

Google unveiled its secret chatbot project, Bard, last week. Google hopes that this will challenge Microsoft’s recently announced Bing + ChatGPT collaboration.

Bard will launch with Google’s LaMDA (Language Model for Dialogue Applications) AI, which gained notoriety last year when an engineer announced he believed it had become sentient. Although it's just starting out, Google has big plans for Bard and will be making updates and improvements in the near future.

Bard’s release didn't exactly go to plan with someone forgetting to give one of the presenters a phone to use in a live demo and the showcase of Bard. Shares in Alphabet slid nearly 9% after the event.

Google’s official Twitter account then provided the wrong information in an example posted on the platform. Given how notorious ChatGPT is for confidently providing incorrect information, you’d think they’d double-check the information from Bard before posting it, but apparently not.

Microsoft has also announced plans to add conversational AI tools to both Bing and Edge, with the help of OpenAI's ChatGPT. Edge, Microsoft's browser, will also be getting an AI upgrade with the ability to summarize reports, make comparisons and even create content.

The integration with Bing seemed incredibly impressive in the presentation at 3.56 in the video below.

You can try out some of the features on the Bing website and sign up for the waitlist.

With Google and Microsoft leading the charge towards more AI-centric search products, the future of search remains uncertain. How will the advertising model work when the answer is given straight to the user, rather than them having to click through multiple pages and view the adverts on them? Will AI search and traditional search be integrated or will two separate formats coexist separately? What do you think? Leave a comment below.

Regardless of what happens, it’s exciting to see Google finally have some competition in the space and it’ll be interesting to see how it evolves in the future.

Will the SEC crack down on crypto staking?

Crypto staking may be under threat in the US. Coinbase CEO, Brian Armstrong, has expressed concern over rumors that the Securities and Exchange Commission (SEC) is looking into outlawing it.

Staking is the process of locking up crypto for a period of time to earn rewards on it. The rewards differ depending on the crypto and the blockchain the currency is staked on. You earn money through staking as it means your “locked up” crypto can be used by the blockchain network to verify transactions, the extra crypto you’re paid is a reward for allowing your crypto to be used in this process.

Coinbase shares fell more than 14% on Thursday after the SEC announced a settlement with Kraken, another large exchange. The SEC alleged that it had engaged in the unregistered offering and sale of what it deemed securities, through its crypto-staking platform.

Armstrong believes that new technologies should be encouraged and not stifled by red tape saying he hopes:

“we can work together to publish clear rules for the industry, and come up with sensible solutions that protect consumers while preserving innovation and national security interests in the U.S.”

However, the SEC believes that, via staking, an individual's crypto can become a security and must therefore be regulated by the organization.

The Week Ahead

The week ahead promises to be interesting with a lot of economic data being released around the world.

On Tuesday, consumer price index (CPI) data will be released in the US. Investors will be looking for signs of slowing inflation. Inflation rose in December when many were expecting it to fall. Strong inflation could force markets to rethink whether the Fed will actually cut rates by the end of the year and could hurt a rally that has boosted stocks and bonds so far in 2023.

UK inflation and jobs data will also be released and will inform the BoE as to whether they should raise rates again.

The Bank of England recently hinted that the recent 50 basis point interest rate increase in February may be the final one for now, however, the inflation report for January, due on Wednesday, is expected to show persistent high prices.

The Bank of England recently predicted that the UK will experience a mild but lengthy economic downturn starting from the beginning of this year and lasting for five quarters.

European GDP data will also be released on Tuesday and forecasts for this quarter are to be released on Wednesday.

With the slew of data being released this week, it’ll likely be a volatile one for stocks, especially. I hope your portfolio performs well through it though, and if not, don’t worry - it’s all about the long-term anyway! ☺️

Articles/Videos:

Are the Remaining Crypto Giants Staring Down the Barrel of the US Government’s Gun?

Central Bank Digital Currencies Explained

Microsoft's new Bing and Edge hands-on: Surprisingly well-integrated AI