The Potential Of Quantum Computing In Finance

How will quantum computing impact the finance industry, and what current problems can it solve that are beyond the scope of classical computing?

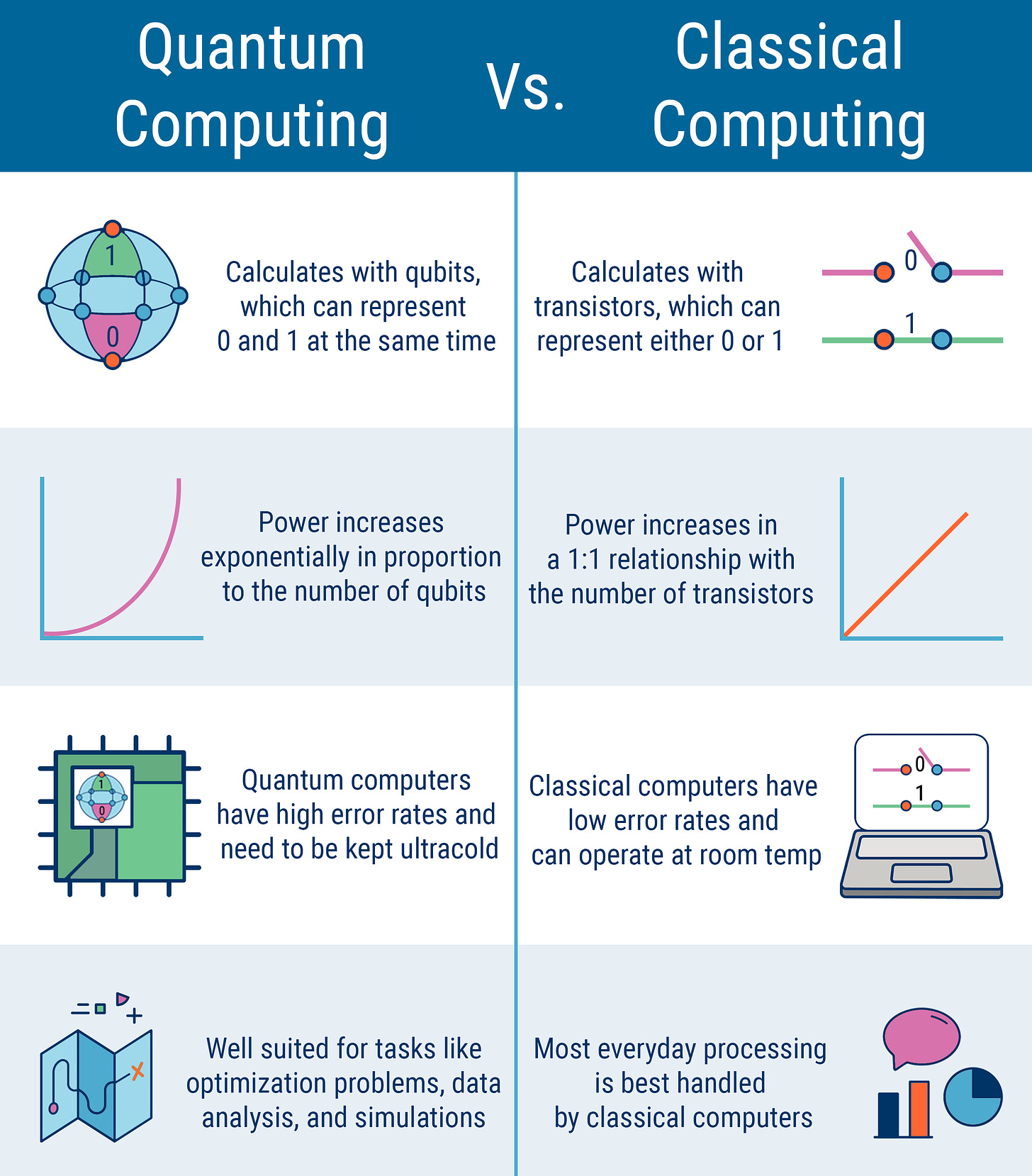

Quantum computing delves into the mysterious realm of quantum mechanics and how it can be leveraged to manipulate data. It stands apart from traditional computing by utilizing qubits (quantum-bits) that exist in a state of limbo beyond the binary confines of ones and zeros.

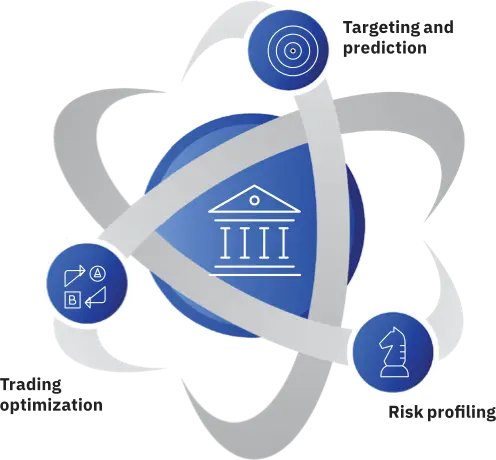

As quantum computing research advances, the world of finance is poised to reap the benefits. The potential for the technology to transform the landscape is immense, with use cases in financial modeling, risk management, and trading.

But what is quantum computing, and how might it affect the financial industry? Let’s dive into the enigmatic world of quantum computing, unveil its potential applications in finance, and confront the roadblocks and constraints of this emerging technology.

What Is Quantum Computing?

Classical computing's binary bits, limited to either 1 or 0, are no match for quantum computing's qubits. Qubits differ from traditional binary bits as they exist in multiple states simultaneously(a property known as supersition), allowing for mind-bogglingly complex calculations to be carried out. This property allows quantum computers to solve what today are practically impossible problems.

But the wonders of quantum computing don't stop there. Entanglement, a particularly weird phenomenon, allows two particles to become linked so that one particle's state depends on the other's, regardless of the distance between them. This paves the way for ultra-fast communication between particles, massively boosting a quantum computer’s processing speed and allowing people to access data faster.

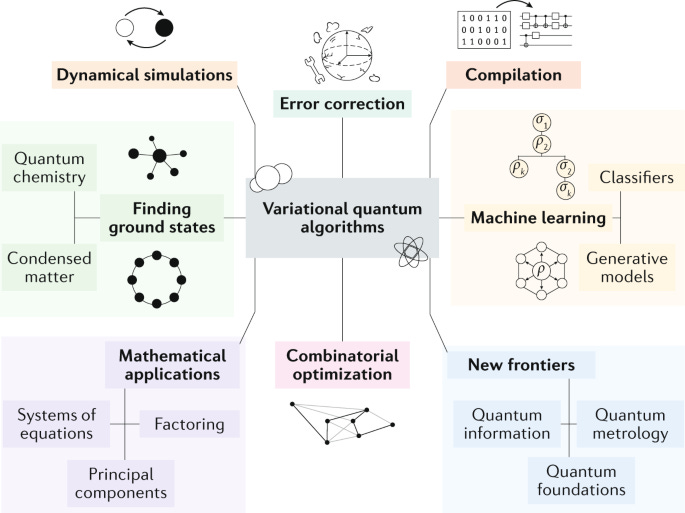

And don’t forget remember quantum algorithms, the essential building blocks of quantum computing. These algorithms are ingeniously designed to capitalize on the unique properties of qubits, leading to lightning-fast calculations. Grover's and Shor's algorithms are just a couple of the most famous that showcase the full potential of the technology.

How Quantum Computing is Changing Financial Modeling

Quantum computing technology unlocks previously unattainable levels of computational power, opening up new avenues for solving complex financial problems.

Quantum computing's ability to analyze vast amounts of data simultaneously and quickly is one of its main advantages in financial modeling. With the capacity to process trillions of data points, quantum computers can identify hidden patterns, enabling financial institutions to build more sophisticated models, and providing insights into market trends and behaviors that were once beyond our understanding.

In fact, quantum computing is already making inroads in financial modeling. D-Wave Systems, a Canadian quantum computing company, has developed a quantum annealing algorithm that streamlines portfolio optimization, paving the way for more efficient portfolio management and perhaps better returns for investors.

Embracing Quantum Computing for Financial Risk Management

Effective risk management is an indispensable aspect of the finance industry; enabling investors to identify and mitigate potential risks associated with their investments and allowing for better informed decisions.

Historically, risk management in finance has relied on traditional computing methods to analyze market trends and predict outcomes. However, with the increasing complexity and volatility of financial markets, traditional computing techniques often need to be revised. The emergence of quantum computing has provided financial institutions with a powerful new tool to enhance risk management capabilities.

Its primary advantage over traditional risk management techniques is its ability to perform complex calculations at incredibly high speeds. This enables financial institutions to process large amounts of data in real-time, resulting in more precise and informed investment decisions.

Quantum computing can also simulate intricate financial systems like stock markets and insurance markets, providing financial institutions with a better understanding of how these systems operate and identifying potential risks before they materialize. With this knowledge, institutions can develop more robust risk management strategies, minimizing the adverse impact of unexpected events.

Quantum Computing: Is It Key to Effective Trading Strategies?

Quantum computing holds tremendous potential in trading, where developing effective trading strategies demands using complex mathematical models to predict market behavior and identify profitable trades.

However, the limitations of traditional computers often restrict the capacity of these models. With their exceptional ability to solve optimization problems central to the development of effective trading strategies, quantum computers have emerged as a game-changer in this arena.

One exciting application of quantum computing in trading is in portfolio optimization, which involves selecting a portfolio of assets that maximizes expected returns while minimizing risk.

This is a challenging optimization problem that can be overwhelming for classical computers to handle. However, quantum computers offer a glimmer of hope by potentially finding optimal solutions much more efficiently and quickly.

One more area where quantum computing can make a difference is in the development of machine learning algorithms for trading. These algorithms are utilized to detect patterns in data that can be used to make predictions about market behavior.

But currently, the size and complexity of the data sets they handle can limit their accuracy. Quantum computers with their unparalleled ability to manipulate large data sets could possibly overcome these obstacles and enable more precise predictions, paving the way for more effective trading strategies in the future.

Navigating the Challenges and Possibilities of Quantum Computing in Finance

Quantum computing is incredibly exciting and provides an avenue to change the way we process information. However, it’s not perfect and carries significant challenges for all industries using it, finance included.

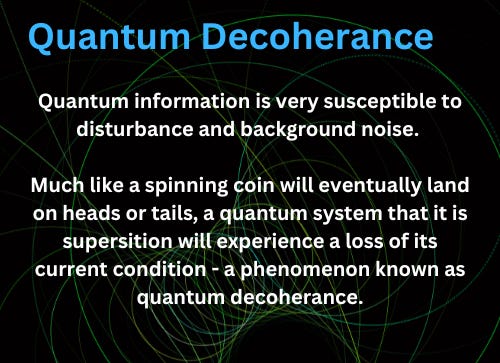

One such challenge is quantum decoherence. In order to understand quantum decoherence we need to know about quantum coherence. Quantum coherence treats all objects as if they have wave-like properties.

The idea is that multiple waves interact in a coherent way to create a single state. However, a quantum state interacts with its surroundings such as temperature, vibrations, and electromagnetic waves. This interaction between the state and the environment can risk leading to the loss or corruption of quantum information because it destroys the properties of the computer.

To stop this from happening in the first place, quantum computers have to operate under very tight conditions. These conditions often include temperature regulation and isolation from external influences. Carefully curated conditions mean that delicate quantum states can be preserved and manipulated without being disrupted by their environment.

Scalability is another considerable challenge potential quantum computing users have to worry about. We've established that quantum computers can outperform traditional computers in specific tasks and complex problems. However, they cannot tackle all complex problems; quantum computers are limited by their capability to handle a greater number of qubits reliably (at the moment).

As the number of qubits increases, errors in quantum computation can quickly compound, limiting the scalability of quantum computing technology. This can make integration into existing financial systems challenging and consequently will require considerable investment and development to ensure that quantum computing can be effectively integrated into the economic infrastructure.

It’s not just the technical challenges that people are worried about, there are also ethical concerns surrounding using quantum computing in finance. Some worry that quantum computing could be used to develop trading strategies that exploit market inefficiencies, resulting in unfair advantages for only the richest investors.

As such, there have been calls by researchers to establish ethical standards for using quantum computing in finance to ensure the technology is used in a way that is not open to abuse.

Final Thoughts

Despite its nacesny, quantum computing has a profound potential to overhaul the financial industry. Enhancing financial modeling, risk assessment, and trading practices is vital. However, challenges and limitations cannot be swept under the rug.

The transition to a world based on quantum computing will require extensive research and development to pave the way for a smooth integration of quantum computing into the economic system. Nevertheless, if quantum computing does become available to the masses, it will likely be looked back upon as a seismic event in the history of humanity.