SoFi Stock Analysis 💳

SoFi is up 20% in the last year and one of the largest holdings in my portfolio. Here's why

**Disclaimer: The information provided herein is for educational and informational purposes only and should not be construed as financial advice. This information is not intended to be a substitute for professional financial advice, analysis or guidance. Any actions taken based on the information provided are at the sole discretion and responsibility of the reader.**

SoFi, short for Social Finance, is an American fintech company based in San Francisco. It was founded in 2011 and its current CEO is Anthony Noto.

It provides customers access to a range of loans, credit cards, investing, and banking services through both its mobile and desktop platforms. Customer reviews are almost entirely positive towards the company’s app thanks to its simple user experience and wide product offering.

It currently has about 4,200 employees and a market cap of $7.9 billion. It says its mission is to “help our members achieve financial independence in order to realize their ambitions”

How close is SoFi to fulfilling this goal and how does it hope to do it?

Business Model 💼

SoFi has developed a suite of financial products to help it serve its customers. Its “member home feed” is personalized to each user and informs said user about what they can do that day to improve their financial life.

SoFi says that through this feed, there are significant opportunities to build engagement and that it has been an important driver of new product adoption up to now.

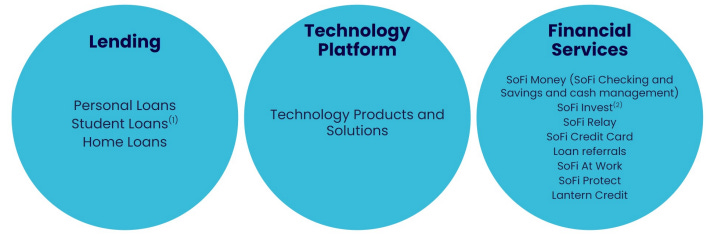

The company has three business segments:

Lending

SoFi initially started by refinancing student loans, primarily targeting graduates from prestigious universities. This focus allowed them to cater to clients with potentially higher earning power and lower risk profiles.

Over time, SoFi broadened its lending portfolio to include personal loans and mortgages, helping it appeal to a wider customer base. Their approach combines traditional financial underwriting with modern data analysis and customer service strategies allowing SoFi to offer competitive rates and terms while maintaining a focus on high-quality customer interactions.

What sets SoFi's lending segment apart from others, is its emphasis on community. They offer customers benefits such as career counseling and networking events, helping to underscore their commitment to not just being a lender, but a financial partner.

People can also apply for loans via the app rather than having to go in person to a bank which SoFi says acts as a competitive advantage over other traditional banks.

Technology Platform

SoFi’s technology platform consists of two main products:

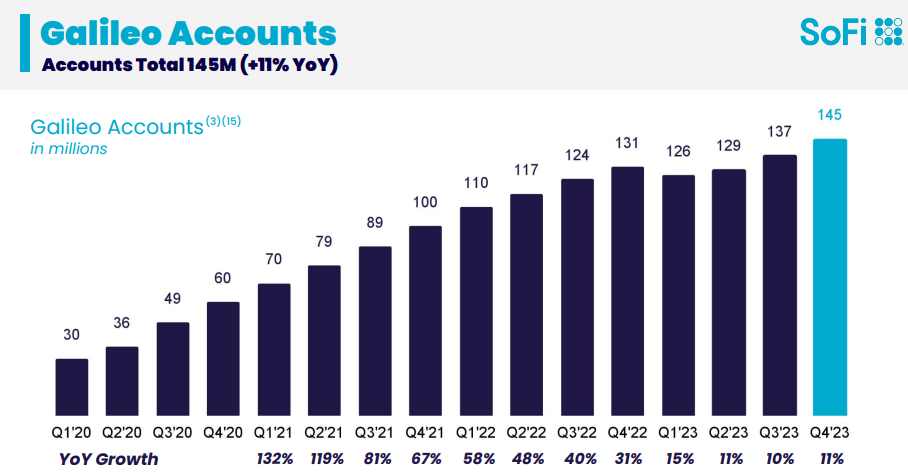

Galileo - SoFi bought Galileo in 2020 for $1.2 billion. It provides a suite of APIs for institutions, enabling them to build secure and scalable financial solutions for their own products. SoFi’s ownership of Galileo and Galileo’s ability to act as a platform for other financial institutions has led to articles citing it as the AWS of Fintech.

Technisys - Acquired by SoFi in March 2022 Technisys is a cloud-native and digital banking platform with financial services customers. Technisys earns revenue by selling software licenses and support for them to other financial services companies.

Financial Services

SoFi offers a whole host of finserv products including:

Digital checking/savings accounts and credit/debit cards.

Its mobile first investment platform

SoFi Relay - a service that allows members to track all of their financial accounts in one place and use credit score monitoring services.

SoFi at Work - A service through which it partners with other enterprises looking for a way to provide financial benefits to their employees, such as student loan payments made on their employees’ behalf.

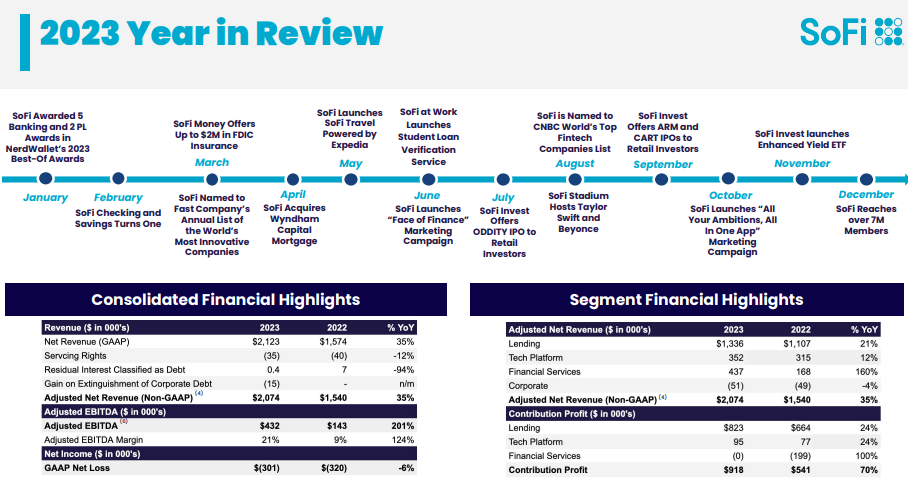

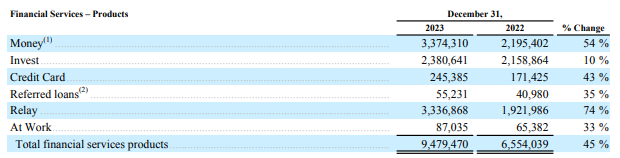

The growth in its financial services segment between 2022 - 2023 was pretty incredible.

We are a member-centric, one-stop shop for financial services that, through our Lending and Financial Services products, allows members to borrow, save, spend, invest and protect their money. - SoFi Annual Report

Financials 📊

Revenue

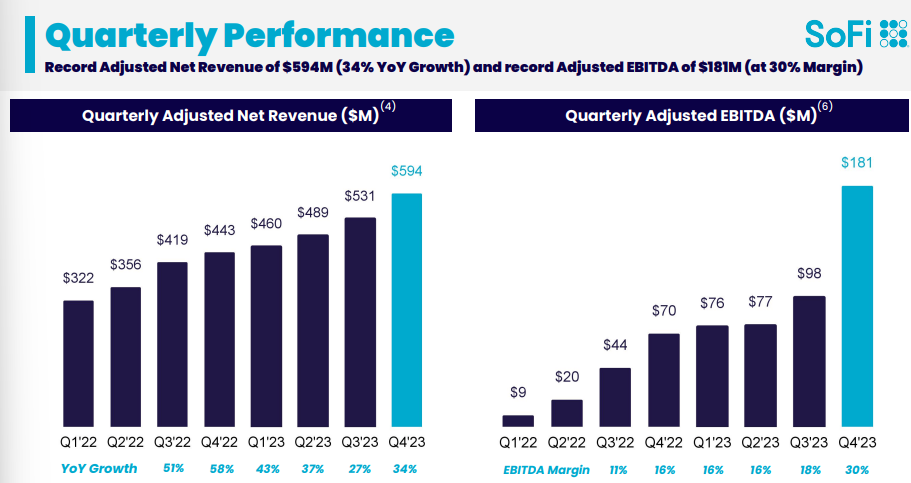

SoFi’s Q4 20023 revenue grew 34% whilst its revenue for the whole of 2023 was 35% up on 2022. The number of users grew 40% in 2023 and it now has 7.5 million members with 11 million products (the number of lending/financial services products that members are using on the platform).

Its revenue and tech platform contributed 40% of Q4 2023 revenue, up from 34% in Q4 2022. Revenue has grown at a compounded annual growth rate of 50% over the last 5 years, a rate few other companies can boast.

Q4 2023 also marked SoFi’s eleventh consecutive quarter of record adjusted net revenue at $594 million.

Assets & Liabilities

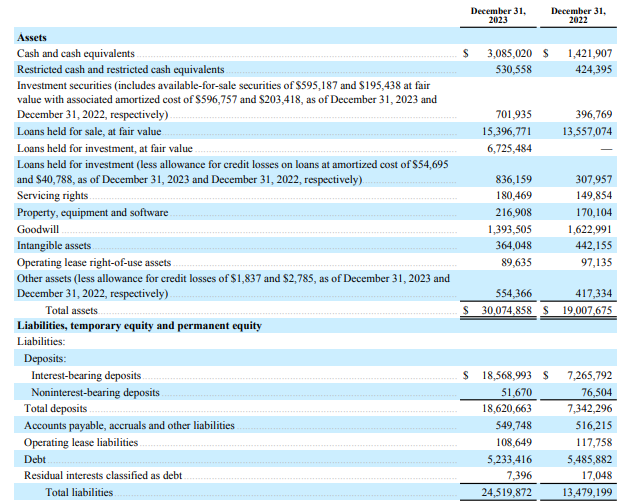

You can see a full breakdown of SoFi’s assets/liabilities in the image below but as of Q4 2023 it had:

Total Assets: $30.07 billion

Cash - $3.08 billion

Loans held for sale - $15.4 billion

Loans held for investment - $6.73 billion

Goodwill - $1.4 billion

Total Liabilities: $24.52 billion

Deposits - $18.6 billion

Debt - $5.2 billion

Profit & Loss

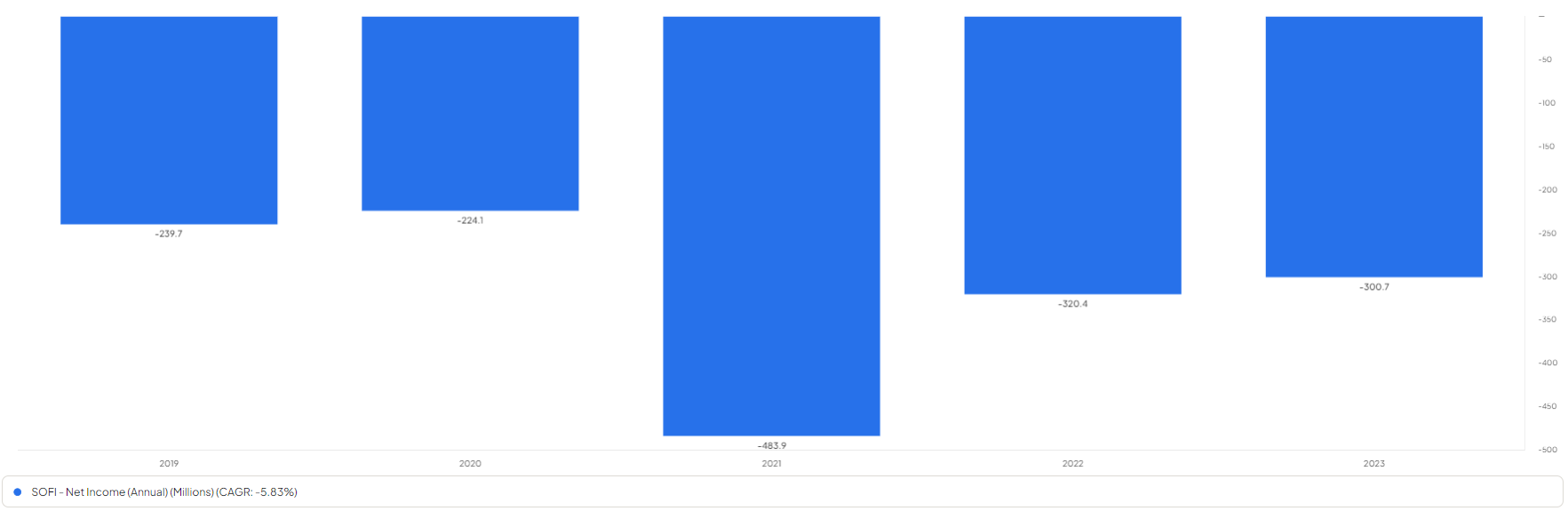

SoFi reported its first ever profitable quarter in Q4 of 2023 with a net income of $48 million and earnings per share of $0.02, it made a loss of $40 million in Q4 2022.

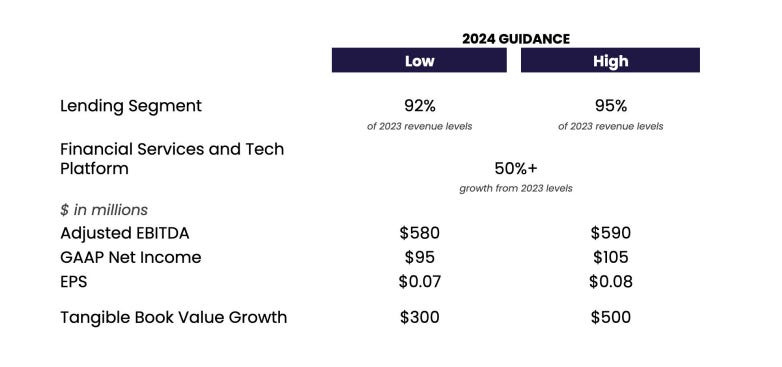

It expects to make a profit of $95 - $105 million for the whole of 2024, equivalent to earnings per share of $0.07 - $0.08.

This would finally put an end to its losses and put it in a good position to grow even more throughout the 2020’s.

Risks ⚠️

SoFi faces a range of risks in the highly competitive fintech sector but here are a few of the most important ones.

Competition

Perhaps the foremost challenge is the intense competition from both traditional banking institutions and emerging fintech startups.

Established banks, with their deep financial resources and extensive customer bases, are increasingly adopting digital strategies to cater to the modern consumer, directly competing with SoFi's target market.

The fintech sector is characterized by rapid innovation and constant entry of new players, often armed with disruptive technologies and business models. These startups, such as Revolut or Chime, focusing on niche segments or novel financial solutions, could eclipse SoFi's innovative edge.

Regulatory

Another critical aspect is the regulatory landscape, which in the financial sector is stringent and ever-evolving. Compliance with these regulations requires significant resources and expertise, and any changes in the regulatory framework can affect newer and smaller entities like SoFi, challenging their operational flexibility and scalability.

Cybersecurity

SoFi must continuously invest in advanced and secure technological infrastructure. Being a digital-first entity, it faces the ongoing challenge of protecting against cybersecurity threats, where any significant breach can severely damage customer trust and the company's reputation.

Future Prospects 🔍

SoFi’s recent growth has been nothing short of exceptional. With a compounded annual growth rate of 50% over the last five years, it’s grown at a level few other companies can boast.

For 2024, the company expects a net income of $95 - $105 million vs a loss of $301 million in 2023. SoFi also expects tech platform and financial services growth of 50%+ compared to 2023.

Like many companies, SoFi is integrating AI into its products/services. In August 2023, SoFi announced that it would integrate Cyberbank Konecta, a leading digital assistant into Galileo. Speaking about the integration SoFi said:

“Through Galileo’s flexible APIs and AI-driven technology, Cyberbank Konecta has helped SoFi achieve immediate cost-reduction by freeing up valuable agent time to solve more complex and higher-touch problems for SoFi’s members. Customer service performance has improved by 7%, meaning addressing thousands more conversations 24/7 without the need for member service agents.”

Further integration with AI technology is virtually a certainty and, if done well, will allow SoFi to become more efficient, delivering a better user experience and pushing its profits even higher.

Assuming there are no major changes in the macro environment, in its most recent conference call its CEO said they see revenue from 2023 -2026 growing at compounded rate of 20% - 25%, with a 50% compound annual growth rate for its technology segment.

Offering guidance 3 years into the future is unusual and so much can happen between now and then. But given SoFi’s history of under promising and overdelivering I view the fact that the CEO is speaking so bullishly as a positive sign.

Conclusion 🏁

Its first profitable quarter in Q4 2023 was a bullish sign for the company, as was virtually the entire earnings report. But that doesn’t mean there aren’t problems that can arise over the next few years.

Legacy banks could catch up and build a product as good as SoFi’s whilst ever-changing regulations could put a dent in the young company’s growth.

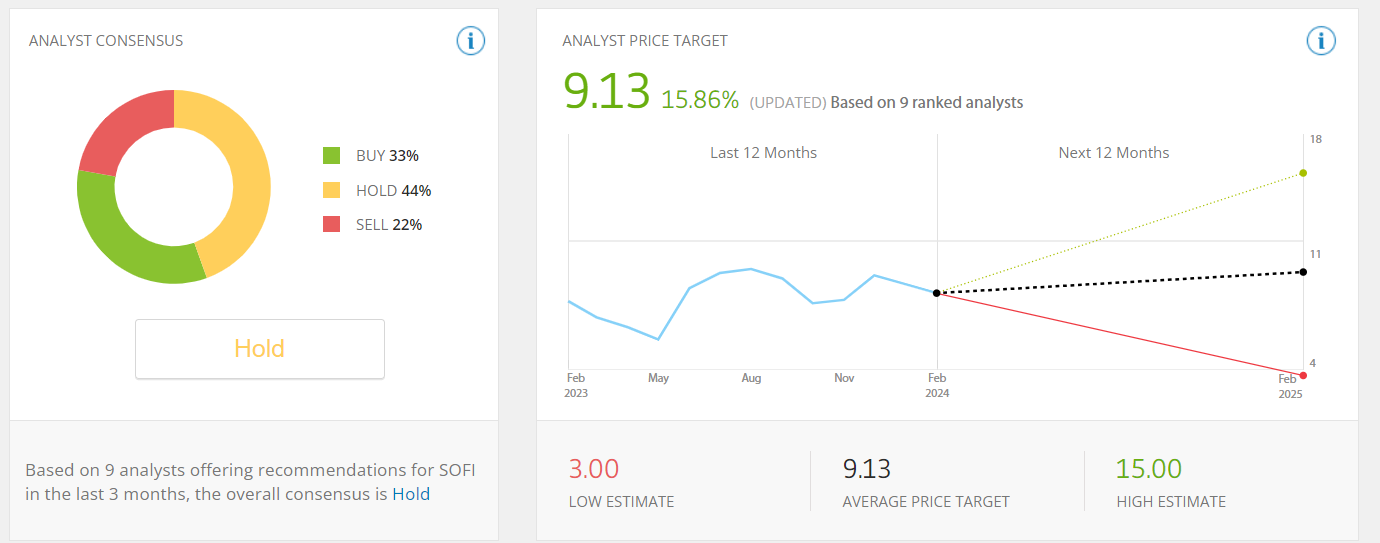

But regardless, in my opinion, the company is a good one to hold for the long term. Risks around competition, regulation and more are inherent in any investment and the risk/reward of investing in SoFi at a price/sales ratio of just under 4 seems reasonable when its revenue is growing 35% a year.

On the Q4 earnings call, highlighting SoFi’s success since he took over, CEO Anthony Noto said:

I'll note the following. When comparing our business to fiscal year 2018, which is when I joined SoFi and we embarked on our new strategy, we have grown annual adjusted net revenue by more than 8x. Annual EBITDA by almost 3x or $660 million, members by more than 11x, total products by 16x and consolidated net interest income by nearly 5x. And since adding several financial services products in 2019, we have grown annual financial services revenue to more than $430 million, financial services products to 9.5 million in total and Financial Services products now comprise 85% of our total products.

If it can execute as successfully in the next 6 years as it has done in the prior 6, SoFi investors should be handsomely rewarded. Whether it can do so or not is something that only time will tell.

Thanks for reading and if you enjoyed this article feel free to share it below 🙏

Harry

What I'm seeing in SoFi stock chart is that it appears to complete the 2022-23 bottom. Which is a good sign - it's ready to resume an uptrend. However, the Percent of Shares held by Institutions is 36,4. This makes me wait before I decide to buy this stock.