Shopify Earnings 🛒

Shopify beat on both revenue and earnings estimates in its report earlier today, so why is it down?

Hi Investors 👋

Shopify’s Q4 was better than expected but the Canadian e-commerce company gave mixed guidance for Q1 2024, helping push the stock down 12% today.

Q4 2023 vs Q4 2022

Revenue increased 24% to $2.1 billion, equivalent to 30% after adjusting for the sale of its logistics business in June 2023.

Gross profit grew 33% to $1.1 billion and gross margin was 49.5% compared to 46% in 2022.

Free cash flow of $446 million compared to $90 million in Q4 2022, free cash flow margin of 21% vs 5% in 2022.

Net cash position of $4.1 billion.

Net income of $657 million compared with a loss of $623 million in Q4 2022.

Full Year 2023

Revenue up 26% to $7.1 billion, from $5.6 billion in 2022.

Free cash flow of $446 million compared to $90 million.

Gross profit up 28% in dollar terms to $3.5 billion compared to $2.8 billion in 2022.

It also had a net income of $132 million, up from a loss of $3.46 billion in 2022 (which was largely down to unrealized losses on investments rather than anything to do with the underlying business itself).

In a press release, Shopify said

2023 was an incredible year for both Shopify and our merchants. Our strong Q4 and annual results are a powerful testament to the progress we have made building fast, reliable, and unified software for merchants of all sizes,” said Harley Finkelstein, President of Shopify. “As we look ahead to 2024, our focus remains on driving innovation in an ever-evolving commerce landscape, delivering products that will propel our merchants’ businesses forward, with the support of our world-class talent and our valued merchants and partners.

Q1 2024 Outlook

Revenue growth of low-twenties percentage rate which translates into the mid-high twenties when accounting for the sale of its logistics business.

Gross margins to increase about 1.5%.

Free cash flow to be high single-digit percentages and increase each quarter throughout the year.

Shopify is fundamentally transforming the way businesses and consumers do commerce. Commerce moves fast, but Shopify moves faster. - Shopify president, Harley Finkelstein.

My Thoughts

Despite the share price falling 12% after the announcement earlier today (it was up about 23% in 2024 to just give some context), I see the earnings report as a positive. Things seem to be going in the right direction and the company managed the pandemic and the fallout of it well.

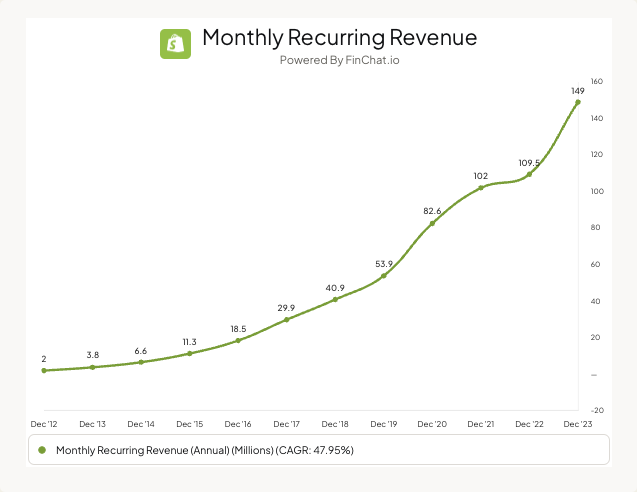

Shopify is still growing around the 20%-25% range and its free cash flow increased massively during last year. It’s trading at about 15x sales so it’s not cheap but you have to pay for quality.

I’m still up about 1,100% on my investment in the company in 2017 and don’t plan to sell anytime soon. If you can stomach the volatility it could still be a good long-term investment. But as always, do your own research before investing!

See my deep dive into the company here.

Disclaimer: Please note that the content provided here, including any suggestions, ideas, and commentary, is for informational purposes only and does not constitute financial, investment, or other professional advice.

Thanks for reading 🙏

Harry

On my watchlist. A fundamentally solid company where I am welcoming drops like these. Good article and update Harry. Thanks!

I wouldn't worry about Shopify. Yesterday's 13,4% drop is nothing - it didn't go below even moderate support. The price is unlikely to go down lower than 71$. Oh and around $71 somebody was accumulating Shopify stock, most likely for an ETF. The stock is at a fundamental level and presents low risk.