Nvidia’s Exceptional Earnings, Snowflake Beats Estimates, Arm IPO, and WhatsApp Goes HD.

Nvidia's earnings were the best I've seen all year and blew analyst expectations out of the water. But what else happened in the world of finance and technology?

Nvidia’s Blowout Earnings

Snowflake Beat Estimates

Arm IPO

WhatsApp’s HD Video Sharing

Nvidia’s Blowout Earnings

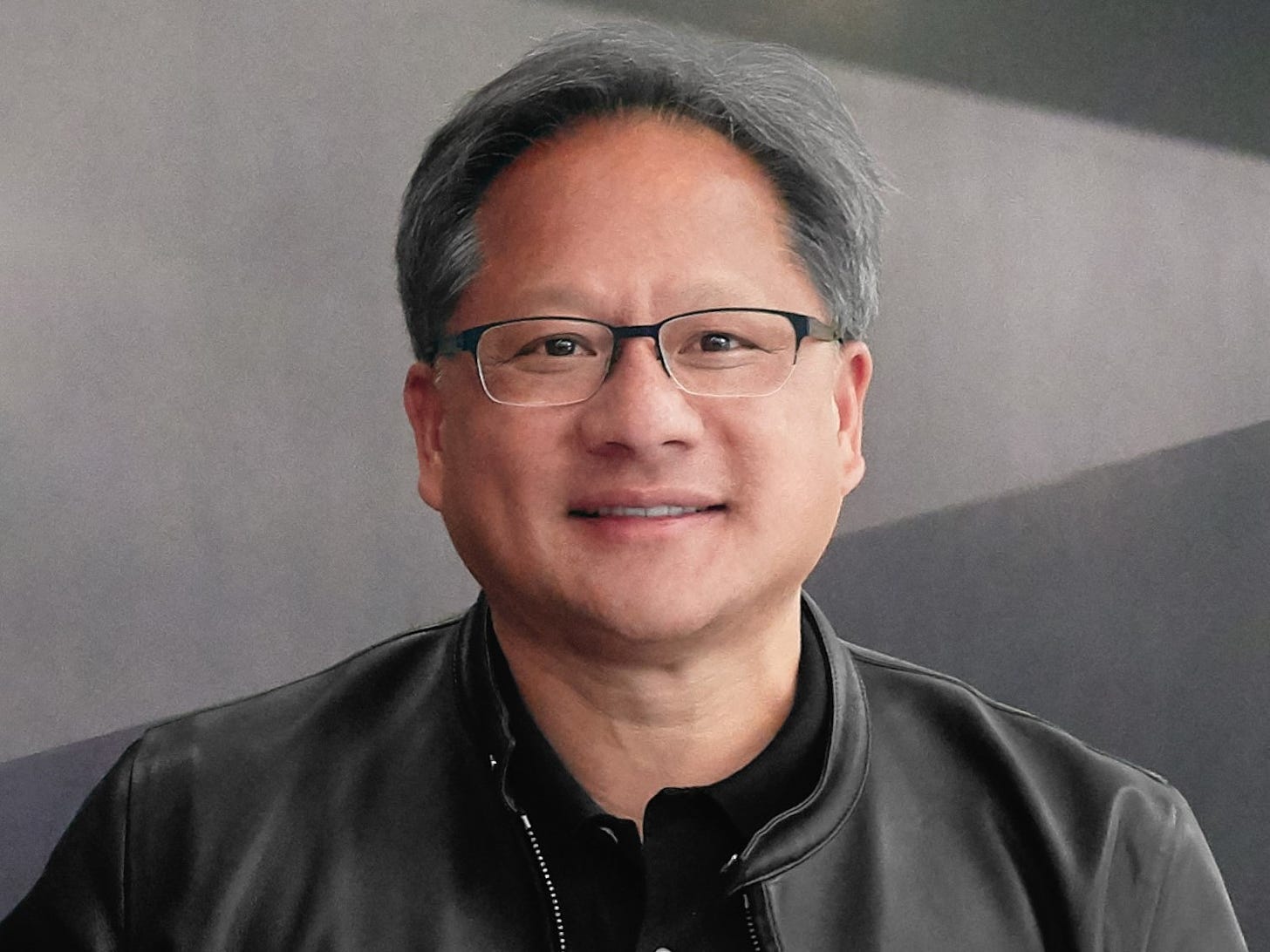

Nvidia's recent Q2 earnings served to highlight the incredibly lucrative potential of the generative AI industry.

The chip design company is at the front of the AI revolution, with their A100 and H100 AI chips being integral in powering AI applications like ChatGPT.

The demand for such advanced applications has grown over the past year, prompting a shift in the infrastructure needed to accommodate them.

Several cloud service providers are now integrating Nvidia's H100 AI hardware into their data centers. As Huang aptly put it, "The race is on to adopt generative AI."

The company’s Q2 performance was stellar, reporting a revenue of $13.51 billion - far surpassing Wall Street's expectations and doubling their revenue from the same period last year.

Their net income also rose, reaching $6.18 billion, a substantial increase from the previous year's $656 million.

While Nvidia's gaming unit continues to grow, it's their data center business that's stealing the spotlight, generating a whopping $10.32 billion in revenue in Q2.

Earlier this month, Huang reflected on Nvidia's strategic decision in 2018 to delve into AI-powered image processing, namely RTX and DLSS. The move has reaped rewards, with the company projecting even more growth in the coming quarters - Nvidia anticipates revenue of around $16 billion for Q3.

Snowflake’s Earnings Beat Estimates

Cloud-data service provider Snowflake (SNOW) experienced a surge in aftermarket trading on Wednesday following their Q2 earnings report.

Revenue: $674 million (36% up over Q2 2022) vs. expected $662 million.

Earnings per Share: $0.22 vs. expected $0.10.

Snowflake's executives maintained their sales forecast for the remainder of 2024. They’re projecting total revenue of $2.6 billion for 2023, 34% up from the previous year.

In May, Snowflake’s shares fell after the company reduced its annual forecast ahead of its Q1 earnings.

In June, Snowflake revealed a collaboration with Nvidia to develop specialized AI language models. This partnership would enable businesses to utilize their data within the Snowflake Data Cloud.

Major corporations have recently been exploring ways to minimize or optimize their cloud service expenditures.

Other cloud company’s earnings were also positive for the most recent quarter. Amazon reported a Q2 sales growth for its cloud-computing division, Snowflake’s stock rose by 3.5% following this.

However, Snowflake's leadership highlighted that their clients remain vigilant about software expenses.

Michael Scarpelli, the CFO, mentioned during the earnings call, "Our projections consider that our major clients will persist as a growth challenge. We notice positive stabilization signs, but not a complete rebound."

William Blair maintained a positive rating for SNOW's stock, with analyst Jason Ader noting, "Despite the ongoing challenges with consumption, the outlook is optimistic. We anticipate that the rise in profitability and AI-driven growth will complement a resurgence in cloud consumption next year."

Snowflake is up 12.5% so far this year.

Arm IPO: AI Hype vs. Slowing Mobile Reality

Arm is gearing up for an IPO, with the tech world keenly watching. Amidst the vibrant circus of AI, mobile, and US-China relations, you have to wonder if the hype around AI's potential can eclipse the sobering reality of a slowing mobile market.

Arm isn't your typical chipmaker. It doesn't churn out silicon but licenses its intellectual property, providing chip blueprints for tech giants like Apple and Nvidia.

While it's a behemoth in the mobile world, recent figures show a slowdown; the company witnessed a 1% revenue drop, reaching $2.68 billion in Q1 of this year.

After SoftBank acquired a 25% stake in Arm from last week, valuing it at $64 billion (a stark contrast to its purchase price of around $30 billion in 2017), Son boldly proclaimed ambitions of orchestrating the most significant semiconductor IPO in history.

The heart of the problem lies in the mobile vs. AI debate. With Arm's designs featuring in about 30 billion chips a year, it's clear they dominate beyond just mobile. But with AI being the buzzword, does Arm have a stake in this evolving space?

As it stands, not quite. But while Arm doesn't have a direct AI business, it can aid companies in designing chips and help them integrate AI functionality.

Another dimension is China. Arm China, the biggest customer for Arm, is majority controlled by Chinese government backed entities.

This relationship has seen its ups and downs, with payment delays and past conflicts of interest adding to the tension.

Arm's deep exposure to China means that political dynamics and economic risks in the region directly influence its fortunes.

With the IPO market’s recent lull, Arm's debut on the public markets will be a litmus test and it could pave the way for other tech firms to go public.

With the likely major AI developments in the next few years and the growth of mobile in the rear-view mirror, it’ll be up to investor sentiment to determine whether Arm's future prospects can outweigh its current challenges.

WhatsApp Introduces HD Video Sharing Capability

WhatsApp continues to enhance its video sharing experience. Following its recent announcement on supporting HD photos, the messaging giant has now confirmed HD video sharing will soon be available to all users.

Here's a breakdown of the new feature:

Last week's announcement celebrated the addition of HD photo sharing, catering to users' demands to maintain the high resolution of images when sharing them with contacts.

As of today, the HD video support, eagerly anticipated by many, has officially started rolling out for both iOS and Android platforms.

Previously, sharing high-definition videos on WhatsApp meant the clips got compressed to 480p due to the platform's resolution restrictions. The new update allows users to share videos in higher clarity, capped at 720p.

A prompt then offers the choice between 'Standard Quality' and 'HD Quality', alongside displaying the respective file sizes.

For recipients on the other end, an 'HD' badge will appear on the video thumbnail.

WhatsApp has initiated the feature's deployment. If it hasn't appeared on your app yet, it's only a matter of time before it does!