Apple's AI Ambitions 🤖 Solana Booms ☀️ Argentina to Accept Bitcoin 🪙

I just wanted to take a quick moment to say a massive thank you to all of you for being a part of my newsletter journey this year. It's been a blast sharing stories and updates with you.

Apple’s AI Ambitions

UK Inflation Lower than Expected

Solana Booms

Argentina Decides to Accept Bitcoin

Merry Christmas!

Hey everyone!

Just popping in to say Merry Christmas! 🎄 I hope you all have a fantastic day filled with good food, great company, and a whole lot of holiday joy.

I just wanted to take a quick moment to say a massive thank you to all of you for being a part of my newsletter journey this year. It's been a blast sharing stories and updates with you. Your support and engagement mean the world to me.

As we wrap up this year and dive into the next, I'm excited to see what's in store for 2024.

I plan to make some changes to my Substack next year and make it less newsy and more focused on investing, finance and give more of my own opinion on certain topics. If you have any suggestions I’d love for you to share them in the comments below.

Here's to a wonderful holiday season and an even better New Year!

Thanks!

Harry

Apple AI Ambitions 🤖

Apple's latest research into using large language models (LLMs) on smartphones offers the clearest sign yet that it aims to match its Silicon Valley peers in the field of generative AI.

Its new paper, LLM in a Flash, addresses a significant computational challenge - the efficient operation of LLMs on devices with limited memory.

LLMs, which power applications like ChatGPT, typically require the enormous computational resources of large data centres, far beyond what’s available on an iPhone.

The paper follows Apple’s efforts to support image-generation models like Stable Diffusion on its own custom chips.

Amid a challenging year for the smartphone market, with a 5% drop in shipments, device makers and chip manufacturers are looking to AI as a way to rejuvenate the product.

Despite being an early player in virtual assistants with Siri in 2011, Apple has been perceived as trailing behind in the generative AI surge that has captivated Silicon Valley since OpenAI's introduction of ChatGPT.

Google has also recently revealed a version of its Gemini LLM for its Pixel smartphones, highlighting the industry's move towards native AI capabilities on devices.

Some analysts believe that devices launching in early 2024 will have generative AI applications built into them and will help spark a new wave of smartphone innovation.

UK Inflation Lower than Expected 📉

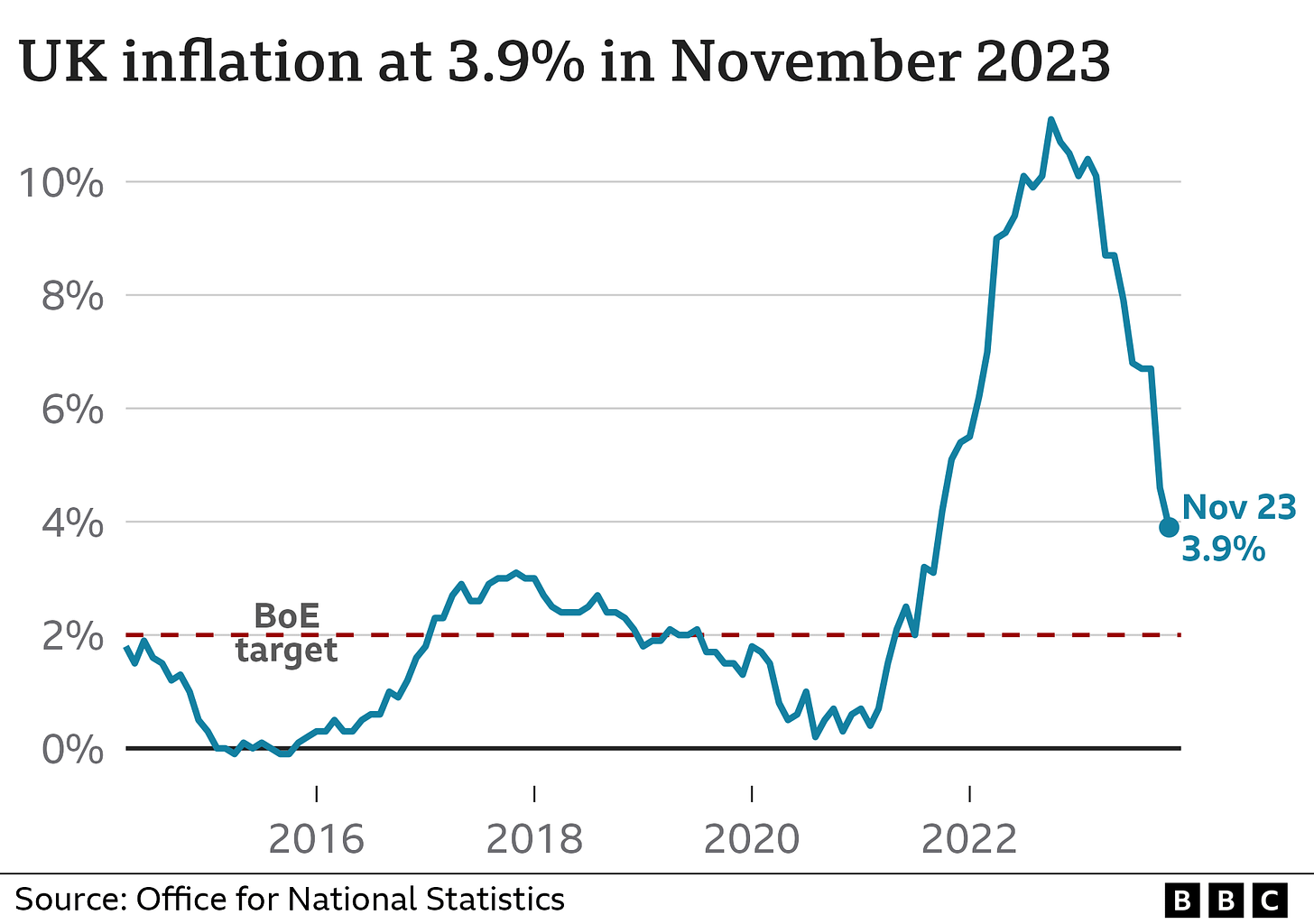

UK inflation experienced a significant drop in November reaching its lowest level in over two years.

This development has led investors to increasingly bet on the Bank of England cutting interest rates in the first half of the next year.

The annual rate of inflation fell to 3.9% from October's 4.6%, partly due to lower petrol prices, marking the lowest rate since September 2021.

The increase was lower than analyst expectations which were about 4.4%.

Core inflation, which excludes energy and food prices, saw an unexpected sharp decline to 5.1% from 5.7%. Services inflation, closely monitored by the Bank of England, decreased to 6.3% from 6.6%.

The news means that rate cut by May 2024 is now more likely, with nearly a 50% likelihood of a cut by March. Britain's headline inflation rate now aligns with that of France, removing its status as an international outlier.

However, the nearly 21% increase in consumer prices since 2020 remains the highest among the Group of Seven advanced economies and is the joint-highest in western Europe.

CPI inflation had reached a 41-year peak of 11.1% in October 2022, largely driven by a spike in energy prices following Russia's full-scale invasion of Ukraine, exacerbating existing supply chain issues from the COVID-19 pandemic.

A smaller monthly increase in food and drink prices compared to last November also contributed, though these remain 27% higher than two years ago and have risen over 9% in the past 12 months.

The central bank remains concerned about the slow decline in high wage growth rates due to recent inflation experiences and a relatively tight labor market, posing challenges for bringing CPI back to the Bank's 2% target.

Solana Booms ☀️

Last week was great for Solana (SOL), with the popular cryptocurrency rising 57%.

The growth was driven by a combination of positive factors within Sol’s expanding ecosystem. It passed Ripple and became the fifth-largest cryptocurrency in terms of market cap.

Solana’s a key player in the evolving DeFi landscape. A recent positive tweet from Solana's official account hinted at a new era in decentralized finance on their platform, indicating an unfolding story.

Solana's progress is highlighted by comparisons with Ethereum, especially in decentralized exchange (DEX) volumes.

Solana has exceeded Ethereum in 7-day DEX volume, recording $9.03 billion in trades versus Ethereum's $8.836 billion, a notable achievement given Ethereum's longstanding dominance in the DeFi industry.

The increase in trading and liquidity supports Solana's anticipated $100 price target.

Protocols on Solana's network are also thriving. Jito, a liquid staking protocol, has secured over $570 million, and its recent $225 million airdrop to SOL holders has attracted more capital to the ecosystem, boosting Solana's growth.

Often referred to as the “Ethereum Killer,” Solana still faces challenges, mainly due to past network issues, if it’s to to truly challenge Ethereum.

The network has however shown improved stability since a major outage in February, even with increased activity. Cathie Wood, CEO of ARK Invest, has also praised Solana for its speed and cost efficiency over Ethereum.

Solana currently trades at about $110.

Argentina Decides to Accept Bitcoin 🪙

Argentina's government has recently approved the use of Bitcoin for formal agreements.

This news was announced on X by the country's Minister of Foreign Affairs, Diana Mondino. In her statement, Ms. Mondino expressed the government's readiness to recognize and formalize contracts made in Bitcoin.

This decision comes a day after President Javier Milei revealed plans to deregulate Argentina's economy, which is facing its own challenges.

His strategy involves modifying or abolishing over 300 regulations through presidential decrees, impacting areas such as rent and labor practices.

Ms. Mondino's post on Thursday also said "In Argentina, it is now possible to enter into contracts using Bitcoin, as well as other cryptocurrencies or even tangible assets like kilos of beef or liters of milk."

During his presidential campaign, Mr. Milei had spoken highly of Bitcoin, criticizing the central bank as a deceptive institution and praising Bitcoin for returning monetary control to the private sector and protecting citizens from inflationary policies.

While specific details regarding the implementation and legal aspects of this policy haven't been fully detailed by Ms. Mondino, her announcement is a significant move towards recognizing Bitcoin as a valid medium for legal agreements.

Argentina, Latin America's third-largest economy, is grappling with severe economic challenges, including over 160% annual inflation and a poverty rate affecting 40% of the country.

If you enjoyed this post please share it by clicking below!