Sam Bankman-Fried Convicted 🧑⚖️ Starlink Breaks Even 📡 Palantir and Shopify Earnings 🤖 Newsletter #30

FTX founder Sam Bankman-Fried (SBF) was convicted of fraud and money laundering by a New York jury on Thursday. He’ll likely spend decades, and potentially the rest of his life, in prison.

Sam Bankman-Fried Convicted of Fraud

Starlink Breaks Even

Fed Holds Interest Rates at 22 Year High

Palantir and Shopify Earnings

Bank of England Expects Inflation to Fall

Sam Bankman-Fried Convicted of Fraud 🧑⚖️

FTX founder Sam Bankman-Fried (SBF) was convicted of fraud and money laundering by a New York jury on Thursday. He’ll likely spend decades, and potentially the rest of his life, in prison.

At the end of what was undoubtedly the highest crypto-related trial ever, it took the jury less than five hours to convict SBF of seven charges including wire fraud, conspiracy to commit securities fraud and money laundering.

US Attorney, Damian Williams, said “while the cryptocurrency industry might be new . . . this kind of corruption is as old as time.”

Originally placed under house arrest, he was sent to jail in August for violations of his bail conditions. These included using a VPN to watch a football game and leaking the diary entries of his ex-girlfriend, Caroline Ellison, who’s pleaded guilty to the charges against her.

The end of the trial comes almost exactly 12 months after the bankruptcy of FTX which led to a crypto crash at the end of 2022. The market has since recovered and the price of Bitcoin is up about 110% so far in 2023.

SBF will be sentenced on March 28th next year.

Starlink Breaks Even

Elon Musk announced last week that SpaceX’s satellite internet unit, Starlink, had achieved breakeven cash flow.

The satellite network now has around 5,000 satellites in orbit, making it the world’s largest satellite operator.

Unfortunately, SpaceX hasn’t actually posted any exact numbers to back up the claim but Musk said in 2021 that Starlink would be split off from SpaceX and go public once it achieved break-even cash flow.

SpaceX’s total revenue was $1.4 billion in 2022, way short of the $12 billion it projected in 2015 so whether Starlink will go public remains to be seen.

It’s still a crucial source of revenue to help fund SpaceX’s more capital-intensive projects and its ultimate goal of getting humans to Mars.

Fed Holds Interest Rates at 22 Year High

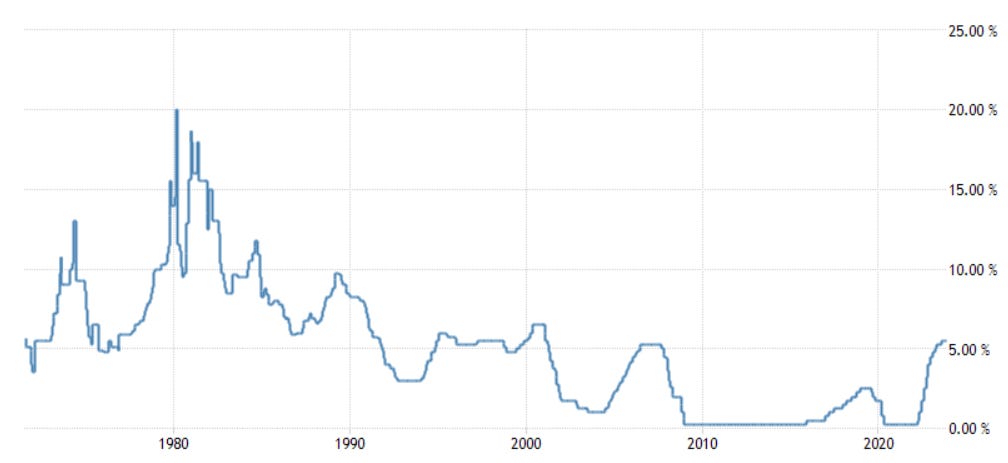

The US Federal Reserve opted to hold interest rates at between 5.25 - 5.5% last Wednesday, their highest level in 22 years, but acknowledged that further monetary tightening might be necessary given the strength of the US economy.

This was the second consecutive meeting where the Federal Open Market Committee decided not to increase interest rates.

Positive economic indicators, such as a solid job market and vigorous consumer spending, contributed to faster than expected GDP growth during Q3.

He also said the bank could afford to proceed carefully with future decisions given that past rate rises now seem to to having an effect on the economy, and that the Fed is not yet considering cutting rates next year despite some analysts who thought this was likely.

The news comes against a backdrop of ongoing strength in the US economy, with consumer spending remaining high and unemployment historically low. Inflation measures have fallen well below their peak of 9.1% in June 2022 and now stand around 3.7%.

Work remains to get them down to 2%, but it seems like the Fed’s measures so far have been working well.

Palantir and Shopify Earnings

Palantir 🤖

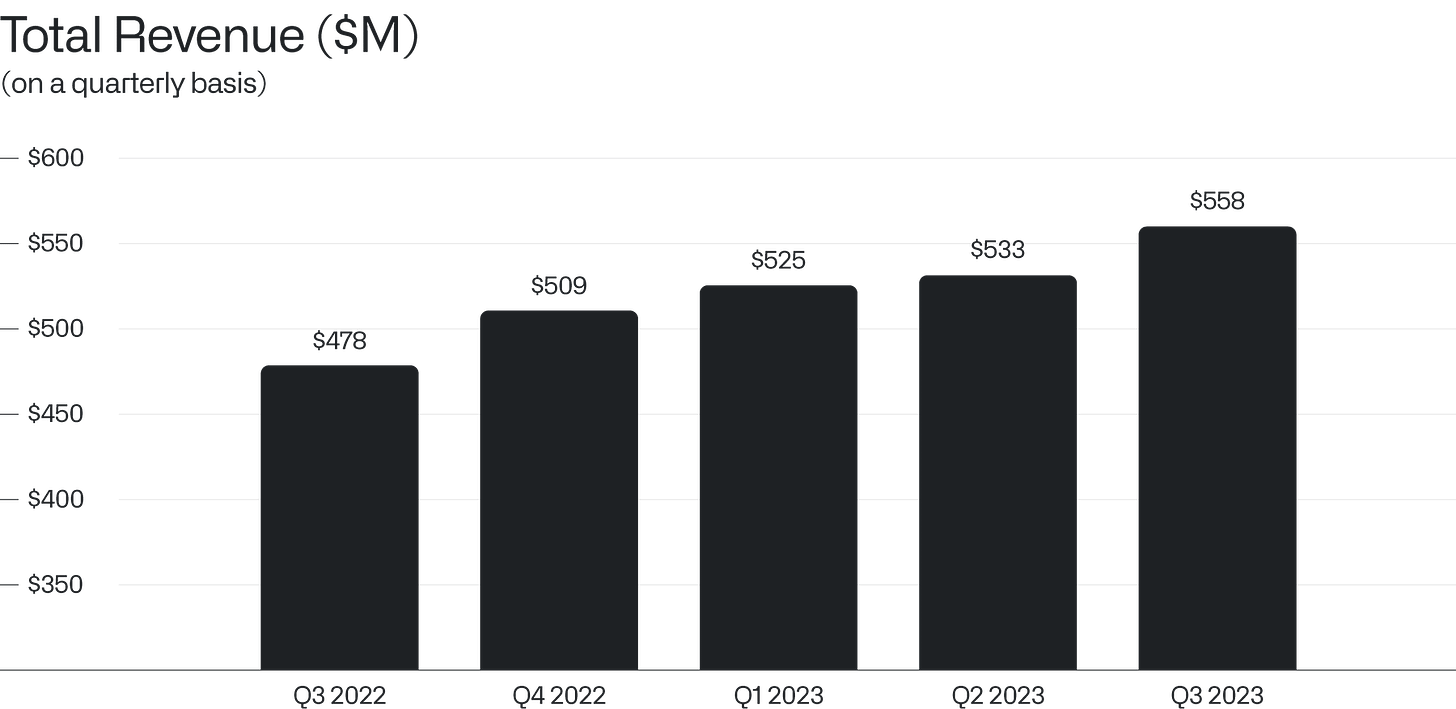

Shares of data analytics company Palantir popped 20% last Thursday after the company released Q3 earnings that beat expectations.

Revenue - $558 million vs $556 million expected.

Earnings per Share - $0.07 vs $0.06 expected.

Revenue was up 17% year on year and Palantir raised full year revenue guidance to roughly $2.22 billion, slightly above the $2.212 billion it forecast in May. US commercial customer count was up 37% year on year, going from 132 customers to 181.

The prior quarter also marked the fourth consecutive profitable quarter for Palantir and now means it’s eligible for inclusion in the S&P 500.

In a letter to shareholders, CEO Alex Karp said “The speed with which our company has shifted from losses to profits is a reflection of the power and sophistication of the software platforms that we have built and refined for years.”

Shopify 🛒

Shopify’s Q3 earnings also beat expectations and gave a strong forecast for the remainder of 2023.

Revenue - $1.71 billion vs $1.6 billion expected.

Earnings per Share - $0.24 vs $0.14 expected.

The company said it expects revenue for the whole of 2023 to grow at a mid-twenties percentage rate and strong revenue growth in the high teens for Q4.

The total volume of merchandise sold on the platform rose 22% to $56.2 billion and total profit was $718 million vs a loss of $158.4 million in the same quarter of 2022.

During the quarter Shopify also announced new AI tools for sellers on the platform, a partnership with Amazon to allow its merchants access to fast and free Prime delivery on their stores.

In May Shopify laid off 20% of its employees and sold its logistics unit in a cost-cutting effort which, thankfully for investors, seems to be working.

Bank of England Expects Inflation to Fall

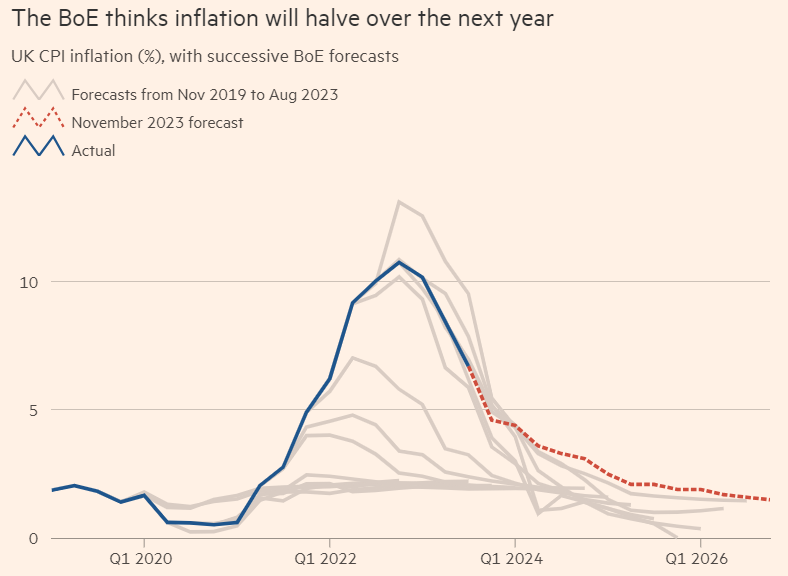

The Bank of England (BoE) has warned that it expects interest rates to remain at 5.25% for an “extended period of time” despite the UK economy’s poor health.

The central bank said growth would be “well below historical averages” and that inflation will remain higher for longer than previously expected.

BoE governor Andrew Bailey said the bank will be watching closely but that it’s too early to be thinking about cutting rates. It’s a delicate line between beating inflation and not pushing the UK economy into recession.

Inflation is at 6.7%, their highest since the financial crisis in 2007 and GDP growth in Q4 of this year is expected to be just 0.1% and remain around there throughout 2024.

The BoE forecasts that inflation will only drop below the bank’s 2% target by the end of 2025 and will still be at 3.1% by the end of 2024.