Alibaba’s Split

Tech Leaders Sign Letter to Delay AI Research

Twitter Code Leaks

Inflation Continues to Fall

Nasdaq’s Best Quarter Since 2020

Alibaba Split Up

Chinese tech giant Alibaba will be split into 6 separate businesses. The announcement came on the same day that Jack Ma, Alibaba’s founder, returned to China after more than a year away.

The whole company is currently worth about USD $315 billion making it the third largest company in China behind Tencent, another tech giant, and Kweichow Moutai, a food and beverage company. The split marks the company’s biggest revamp since its founding in 1999.

The business will be split into separate units, each with its own CEO and board of directors. Alibaba CEO, Daniel Zhang, has said the businesses will each be free to raise funds and pursue IPOs independently. Zhang will however, remain CEO of Alibaba Group, which will become a holding company for the other six.

The six divisions are:

Taobao Tmall Commerce Group - Will cover Alibaba’s domestic facing e-commerce marketplaces, over 60% of the company’s total revenue.

Global Digital Commerce Group - Will cover Alibaba’s international marketplaces, just 8% of the company’s total revenue but one of its fastest growing divisions.

Cloud Intelligence Group - Will be made up of Aliabab’s cloud computing and AI research division. The company is currently the dominant player in China's domestic cloud computing sector, with a 36% market share.

Local Services Group - Will include Alibaba’s food/grocery delivery services as well as Amap, it’s maps application. This unit currently makes up just 5% of the company’s revenue.

Cainiao Smart Logistics - Made up of Alibaba’s logistics division. The unit is now a major logistics provider in its own right in China, serving both Alibaba and third-party customers. Cainiao currently makes up 7% of Alibaba's total revenue.

Digital Media and Entertainment Group - Alibaba's Digital Media and Entertainment Group will house Youku, the company's YouTube-esque streaming video site, as well as Alibaba Pictures, its film production unit.

Shares in Alibaba are down more than 60% since the end of 2020 but rose 14% on the announcement of the split on Tuesday. Analysts said the breakup could ease scrutiny over the tech giant whose sprawling business has been a target of Chinese and western regulators for years. It might also lead US regulators to take a softer approach towards the companies when it comes to listing on US exchanges.

Tech Leaders Want to Delay AI Research

An open letter from tech leaders including Elon Musk and Steve Wozniak has called for a six-month pause on AI research. The letter has 1125 signatures as of Sunday evening.

It calls for AI labs to "immediately pause, for at least 6 months, the training of AI systems more powerful than GPT-4" and comes as the rate of new AI product releases explodes, and promises to revolutionize employment and the broader economy.

The letter doesn’t include any signatures from people working at OpenAI, although there are a few from Microsoft.

Many are worried that we simply won’t have time to adapt to the change and that millions will lose their jobs, leading to mass unemployment. Another more serious but genuine worry is that, either through engineering error, bad actors, or even sentience (although primarily the former two), the AI might “go rogue” and begin causing harm to people.

The letter states:

“AI research and development should be refocused on making today's powerful, state-of-the-art systems more accurate, safe, interpretable, transparent, robust, aligned, trustworthy, and loyal.”

This doesn’t seem like a bad idea necessarily but the problem is that the bad actors won’t slow down. Some also worry that this will just stifle innovation in the space and that there’s little real danger from AI itself in its current form.

In an ideal world, we could slow down and pause to fix some of the problems that current AI systems might amplify, primarily misinformation or propaganda. Researchers in Russia or China won’t slow down though, and allowing them to get ahead could lead to a vastly more negative outcome for the west, compared to letting AI research continue at its current rate.

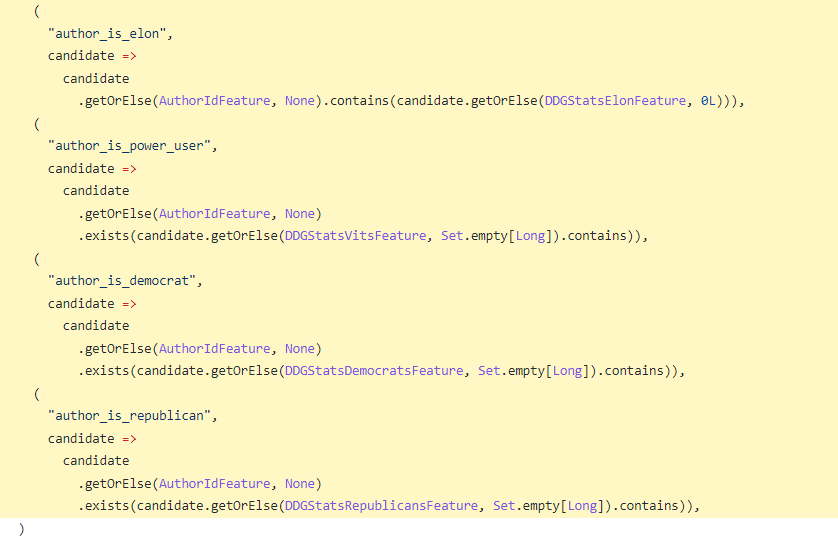

Twitter Code Leaks

Much to Elon Musk’s annoyance, part of Twitter’s source code appears to have been leaked online. The code was found on Github, a collaborative programming site used by developers.

It was removed soon after it appeared on March 24th but according to Twitter, contained “Proprietary source code for Twitter’s platform and internal tools.” It was likely leaked by a disgruntled employee annoyed at Elon Musk’s takeover and the massive layoffs that followed.

Soon after the code was removed, Twitter issued a subpoena ordering Github to identify the user known as "FreeSpeech Enthusiast" and asked for "name(s), address(es), telephone number(s), email address(es), social media profile data, and IP address(es), for the user(s) associated."

In addition to information about the leaker(s) themselves, the order asks Github to identify other users who "uploaded, downloaded or modified the data."

Twitter’s concerned that the data could allow for future hacking efforts against the company or be used by other companies to copy features.

In other Twitter news, the company open-sourced its recommendation algorithm over the weekend and explained how it works in a blog post. Speaking about the release Elon Musk said:

“Our initial release of the so-called algorithm is going to be quite embarrassing and people are gonna find a lot of mistakes but we're going to fix them very quickly.”

Inflation Continues to Fall

Data from the US and Europe on Friday showed that inflation is falling in both.

The Fed's favorite measure of inflation as its fight against inflation goes on. The personal consumption expenditures (PCE) price index, which measures how much people are paying for goods and services increased by 0.3% month on month after increasing 0.6% in January. The index fell to 5% on a year over year basis, its lowest level since October 2021.

Core PCE, which removes volatile food and energy costs and is preferred by the Fed to measure inflation, also rose by 0.3% but analysts were expecting a rise of 0.4%.

In Europe, inflation fell by more than expected to its lowest level in a year, primarily due to falling energy costs. Prices rose 6.9% in March, down from 8.5% in February. European stock markets rose on the back of the news.

Although energy costs came down sharply, food prices didn’t. Indeed it was even higher, up 15% in March compared to 15.4% in February.

Inflation of 6.9% still remains far higher than the European Central Bank’s (ECB) target of 2%. Economists also believe that it will remain higher for longer than hoped, albeit at a lower level.

The past month’s turmoil in the banking sector has raised the prospect of a credit crunch that could slam the brakes on both inflation and growth in the coming months. However, it seems like ECB officials will continue to raise rates at their next policy meeting in May unless the banking turmoil worsens.

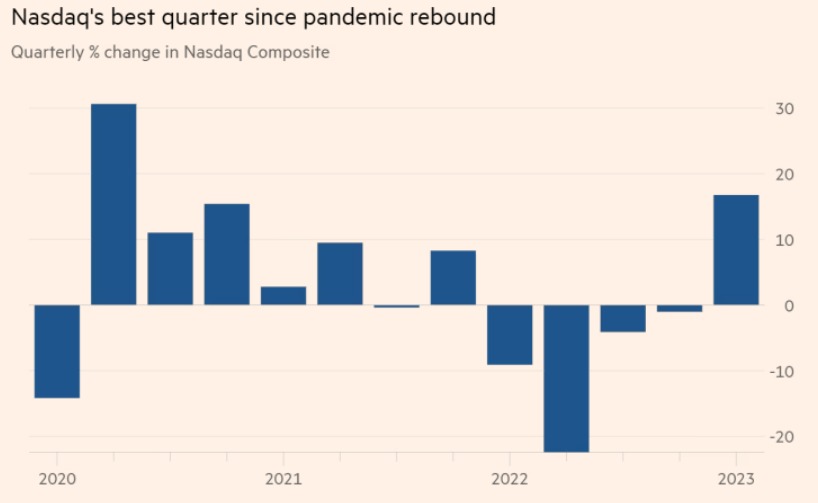

Nasdaq’s Best Quarter Since 2020

The tech-heavy index gained 16.8% in the first 3 months of 2023 as inflation looked to be coming under control and expectations of interest rates were tapered. It rose 1.7% on Friday to end April with a gain of 6.7%.

The broader S&P 500 index was also lifted by tech and was up 7% in the quarter. US indices got a boost on Friday after, as mentioned above, inflation came in cooler than expected.

Tech stocks were the big winners in March after the rotation out of financial stocks due to the Silicon Valley Bank and Credit Suisse troubles earlier in the month.

Delaying AI makes no sense, unless some safeguards or regulations are applied in the due time. Will CloseedAI sign this 🤔