GPT-4's release, Troubles at Credit Suisse, and Meta's Twitter rival. Newsletter #15

OpenAI released GPT-4 last Tuesday to much fanfare. Twitter has been awash with people showcasing its capabilities, including...

Release of GPT-4

Credit Suisse Troubles

Meta’s Twitter Rival

Ethereum Upgrade Date Announced

Release of GPT-4

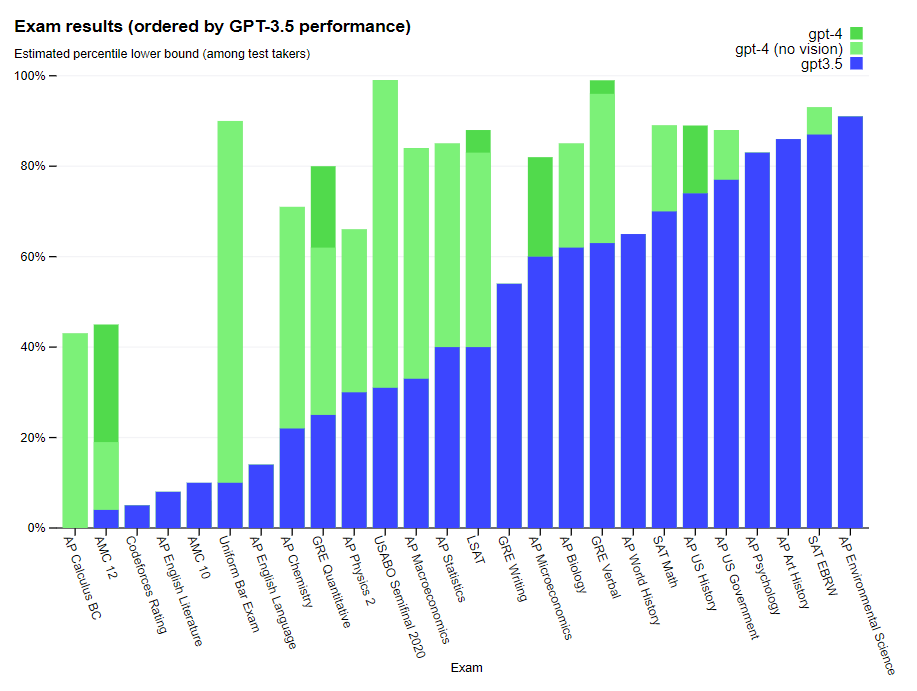

OpenAI released GPT-4 last Tuesday to much fanfare. Twitter has been awash with people showcasing its capabilities, including solving a CAPTCHA, a test designed supposedly to prove that the entity accessing something is human, building a flappy bird game in a single prompt, and showing it a sketch of a website and having it create the site in just seconds.

The main difference between ChatGPT and GPT-4 is that the latter is multimodal - it can understand more than one “modality” of information. This means it can take images as input and describe the image. Although the OpenAI website states “image inputs are still a research preview and not publicly available”, this feature has already been used in a partnership with Be My Eyes. Be My Eyes is an app for the visually impaired and thanks to GPT-4, it now has a “visual volunteer” built in to tell a user what’s in their immediate environment and describe images to them.

“In the short time we’ve had access, we have seen unparalleled performance to any image-to-text object recognition tool out there .” - Michael Buckley, CEO of Be My Eyes.

GPT-4 has also been used in other applications such as Duolingo’s Duolingo Max feature, an app to help the Icelandic government preserve the language, and to combat fraud by the payments company, Stripe.

To access GPT-4 you need to be on the paid version of ChatGPT, or you can sign up for the Bing AI chat preview which runs the GPT-4 model. OpenAI is already making GPT-4 available to third-party developers, so it’s likely that you'll be able to access third-party apps powered by GPT-4 soon.

The release of GPT-4 comes in the same week that Microsoft and Google unveiled new AI tools to help businesses and as MidJourney V5 was released to some customers, an image generation tool that can create photorealistic images, as seen below.

AI technology is certainly moving quickly, probably faster than almost anyone anticipated. It’s an incredibly exciting but worrying time - how will this affect the job market? What will all the people displaced by this technology do? And most serious of all, is there any danger of it going rogue?

Credit Suisse Troubles

Credit Suisse, the second-largest Swiss bank behind UBS Group, has been plagued by issues for years, but last Wednesday, its problems were made plain for all to see.

Soon after the collapse of Silicon Valley Bank on March 10th, Credit Suisse’s largest shareholder, Saudi National Bank (SNB), said in an interview with Bloomberg that it wasn’t considering adding to its investment due to regulatory rules or providing financial help to the bank.

SNB owns 9.9% of Credit Suisse and regulations normally stipulate that one bank normally can’t own more than 10% of another.

The announcement so soon after the collapse of SVB crashed Credit Suisse’s share price by 24% on Wednesday - its largest ever single-day drop. The comments raised the prospect that the bank might have to ask shareholders for more funds at a time when investors were already looking for a weak link in the financial system.

Hours after the markets closed on Wednesday Credit Suisse said it would tap a more than $50 billion lifeline from the Swiss National Bank. Although it may not actually need the money, it’ll help to reassure investors should it need to raise cash quickly. The news sent Credit Suisse’s stock price up on Thursday, lifting other European banks alongside it.

But JP Morgan analysts said Credit Suisse still faces market-confidence issues, even if it doesn’t have a capital problem. Unfortunately, the bank is deeply integrated into the global economy. Should anything serious happen to it, it would likely lead to problems around the world and hit other banks hard.

The problems with Credit Suisse and SVB have raised the prospect of the Fed pausing or scaling back its plans to further raise interest rates to tame inflation. But it’s unlikely that this would be enough to support the US economy in the event of the collapse of Credit Suisse.

Breaking:

Late on Sunday evening Credit Suisse’s Swiss rival, UBS, agreed to an emergency rescue of Credit Suisse after a series of meetings between the Swiss banks and the country’s financial regulators over the weekend.

The Swiss National Bank said the deal was the best way to restore the confidence of financial markets and to manage risks to the economy.

Meta’s Twitter Rival

Just before Meta announced it was laying off another 10,000 staff (after the 11,000 it got rid of in November), it revealed that it was exploring plans to create a rival to Twitter.

A spokesperson for the project told the BBC:

"We're exploring a standalone decentralized social network for sharing text updates. We believe there's an opportunity for a separate space where creators and public figures can share timely updates about their interests."

If it can release it quickly, Meta could benefit from the uproar and negative PR around Elon Musk’s takeover of Twitter, where staff have been fired without being told, and advertisers have left the platform.

The new app is reportedly codenamed P92 and will be decentralized so no single entity can control it, but it’s not clear when/if it will actually be released.

The news comes as Meta’s main platform, Facebook, struggles to attract a younger audience, and as it burns through cash to fund the development of the Metaverse. Instagram is also facing stiff competition from TikTok.

A Twitter-like platform may prove popular given the widespread unpopularity of Elon Musk and his Twitter takeover. If the app can be decentralized and moderation taken out of the hands of Meta, which some see as silencing voices it disagrees with, the new app could provide serious competition to Twitter.

Date Set For Ethereum’s Shanghai Hard Fork

Developers have made April 12th the target date for the long-awaited Shanghai hard fork, more recently called “Shapella”.

The upgrade will mark Ethereum’s full transition to a proof of stake (PoS) protocol by allowing for staked Ethereum withdrawals, many of which will have been locked up since September in the previous Ethereum upgrade, known as The Merge.

How the upgrade will affect the Ethereum price is unknown given the huge quantities that are likely to be unstaked. Coinbase has said it might take weeks for them to process all the unstaking requests, and the price of Ethereum will likely be (even more) volatile in the meantime.

Last week was good for crypto, with Bitcoin and Ethereum both up over 5%. Perhaps this is because of the problems that have engulfed the banking sector recently and cryptos’ perception as a hedge against the banks. Coindesk had a great article on this exact topic last Tuesday - Bitcoin was built for this moment.

Ethereum is already up 48% in 2023 and should the Shanghai upgrade go ahead without any issues, it would pave the way for the next upgrade, Proto-Danksharding, towards the end of this year or 2024.

Great read - thank you! MidJourney blows my mind 🤯

Brilliant content as always Harry 👏🏼