AWS to offer cloud-based AI training, Nvidia beats earnings expectations, and Twitter plans to open source its algorithm. Newsletter #12

AWS partners with Hugging Face to offer cloud-based AI training

Nvidia stock rises after AI chip demand drives growth

Twitter to open source its algorithm

Apple takes a step towards a non-invasive blood glucose monitor

Coinbase to launch its own Layer 2 blockchain

Amazon to Offer Cloud-Based AI training

Amazon Web Services (AWS) has announced it will partner with machine learning firm Hugging Face, to offer developers the ability to create and train AI models in the cloud.

Google and Microsoft have seemingly gotten a head-start in the development of large-language model (LLM) chatbots, but Amazon appears to be taking a different approach to the technology.

They’re more focused on supplying the tools and infrastructure developers need to build the models within their own products. AWS already has a ~34% market share of the global cloud market and it’ll want to maintain that as cloud-based AI becomes a bigger and bigger part of product development.

Hugging Face is a New-York based company founded in 2016 where AI developers can share code and machine-learning models. CEO Clem Delangue, said the company is working closely with Amazon to make it easy for developers to take code from Hugging Face itself and run it on AWS.

The two companies will aim to democratize the AI technology that OpenAI used to create ChatGPT, and accelerate the development of the next generation of generative AI. The move comes as Microsoft partners with OpenAI, and Anthropic, a lesser-known AI safety company, partners with Google.

There’s a lot of consolidation going on in the AI industry right now and it seems like the big tech companies are all preparing for what many see as a major shift in the pace of the development of technology and society as a whole in the coming years.

AI chip demand drives Nvidia growth

Nvidia stock rose 14% on Thursday after the chip company reported higher revenue and income for its fiscal fourth quarter than Wall Street anticipated:

Revenue - $6.05, down 21% from a year ago.

Earnings Per Diluted Share (Diluted EPS) - $0.57, down 52% from a year ago.

For the first quarter of this year, the chip company forecasts $6.5 billion in sales, Wall Street was expecting sales of $6.33 billion.

Its data center business, the part that includes AI-chips, grew and CEO, Jesen Huang, said that AI development is at an “inflection point” and that all businesses developing AI will be pushed to buy Nvidia chips.

"AI is at an inflection point, setting up for broad adoption reaching into every industry. From startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI.”

Perhaps the most interesting point in the earnings report was the announcement that they’re partnering with cloud service providers to offer “AI as a service” to companies and governments. The company said more details will be shared ta their GTC Dev Conference, which will take place on March 20-23.

Their outlook for Q1 of fiscal year 2024 is revenue of $6.5 billion (revenue in Q1 2023 was $8.28 billion) and gross margins of around 64%-66%. The stock was up 45% so far in 2023 even before the earnings report was released, and it’s now up 62.7% for the year so far.

A jump of 14% after announcing an earnings fall of 52% seems extreme and the stock’s still trading at around 100X earnings so much of the future growth is already priced in.

Nvidia stock has performed well so far in 2023, but whether it can hold onto these gains for the rest of the year is uncertain. There's undoubtedly a growing demand for AI chips, but competition in the space is heating up and it’s an area where a lot of well-funded tech companies are starting to get involved. Do you think the competition will prove too much for Nvidia? Let me know below.

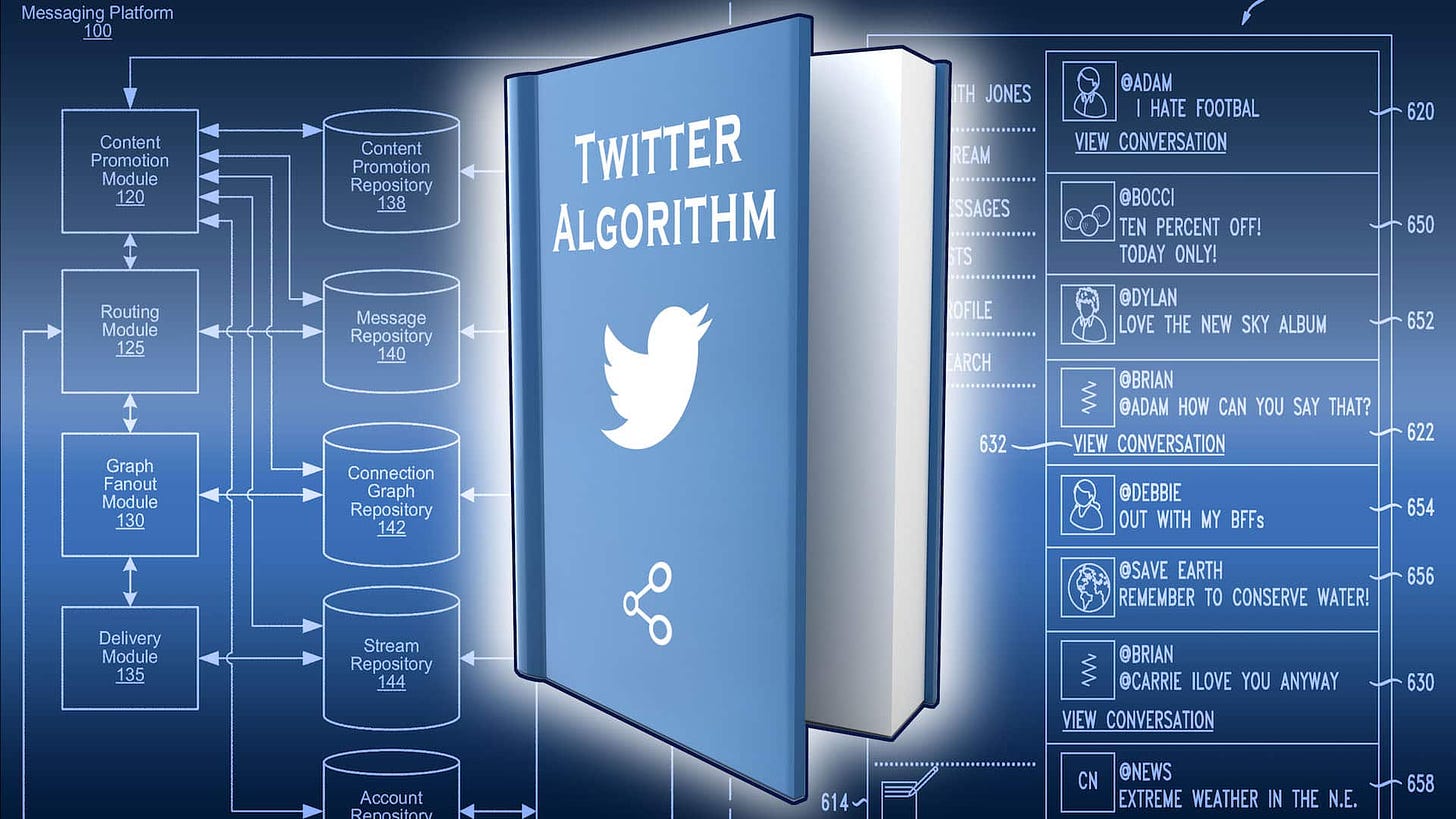

Twitter to Open Source its Algorithm

Elon Musk said last Tuesday that Twitter plans to make its algorithm available for the world to view sometime this week. He’s long been a proponent of making Twitter’s recommendation algorithm open source even before he bought the company, saying in a TED interview in April:

“One of the things that I believe Twitter should do is open source the algorithm, and make any changes to people’s tweets, if they are emphasized or de-emphasized, that action should be made apparent so anyone can see that that action has been taken. So there’s no sort of behind-the-scenes manipulation, either algorithmically or manually”

Making the algorithm open to public scrutiny would undoubtedly increase trust in the platform and allow external researchers to scrutinize its performance, biases, and find ways it could be improved. It might also enable developers to build and develop new applications/features on top of it.

On the other hand, it may also open Twitter up to malicious actors who want to find ways to spread misinformation or propaganda on one of the world’s largest social media platforms. It might also create problems for Twitter in terms of the business itself - other social media platforms could use the algorithm without contributing to its development or sharing their own improvements.

Personally, I think it’s a good thing to make it open source. It increases transparency and even if competitors use it to build their own apps, Twitter already has incredibly strong network effects and will likely add new features in the coming years to make the product itself even more competitive. But as mentioned, the decision to do so is not without risk.

Apple Moves Towards a Non-Invasive Blood Glucose Monitor

Apple’s long-running mission to bring non-invasive blood glucose monitoring to the Apple Watch seems to have passed another barrier. Bloomberg reported on Wednesday that the company has reached a proof-of-concept stage for the technology.

Bloomberg’s report quotes unnamed sources within the company saying the project had recently hit “major milestones” that have made Apple more confident in its commercial potential.

The addition of the sensor to the Apple Watch will mean that wearers can measure their blood glucose levels continuously without the need for skin-pricking or any other sort of invasive test.

Development of the monitor, reportedly codenamed E5 within the company, is thought to date back to 2010, when Steve Jobs acquired RareLight, a startup developing a new method for non-invasive glucose monitoring.

Having the monitor actually put into the watch will likely take a few more years as it needs to be shrunk down further. But it’s another promising step towards non-invasive blood-glucose monitoring, a potentially lucrative market for the company, given there’s thought to be roughly 422 million people living with the condition worldwide.

Coinbase to Launch its own Layer 2 Blockchain

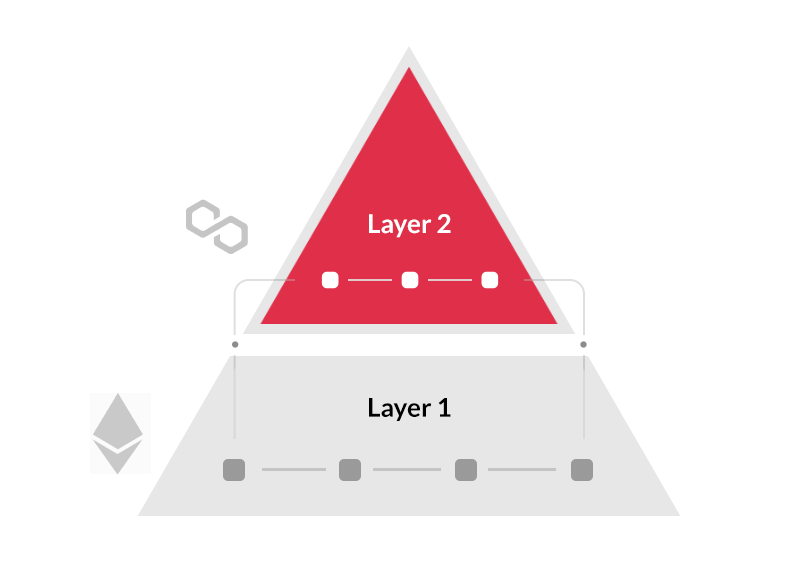

Base was announced by Coinbase on Thursday and will be its new Ethereum-focused layer 2 blockchain - a separate blockchain built on top of another, reducing traffic and congestion on the main network. The project aims to help developers build decentralized applications (dApps) and make it easy for other users to access those apps through Coinbase.

Jesse Pollak, Head of Protocols at Coinbase, said the project’s goal is to help “bring about phase 4 of Coinbase’s master plan: a billion users in the crypto economy.”

A number of crypto companies have already committed to building on Base including Etherscan (an Ethereum blockchain explorer), Chainlink (a network for powering smart-contracts), and Dune (a crypto-analytics company).

Base will be open-source and should reduce transaction fees on the main Ethereum network whilst improving the speed and maintaining security. The project is still in its testing phase but will reportedly be launched in Q2 of this year, control of it will be decentralized away from Coinbase in the coming years.

Thanks

If you’ve enjoyed this article leave a like below and let me know what you think in the comments!

I’ve got more plans for the newsletter but I don’t always email the articles out (I don’t want to spam you!), but keep an eye on the main page for new ones.

See you all next week! 😄