How do you invest? Do you buy growth stocks - companies that are expected to grow at an above average rate in the future? Or do you prefer value stocks - companies whose share price has dipped below what you believe is its true value (also known as its intrinsic value)?

Regardless of investment strategy, many would argue (and I would agree) that the most important thing when investing is maintaining a long-term focus - unfortunately, it’s also one of the most difficult. In this article, we’ll look at why it’s so difficult, despite, in theory, being so simple.

The Benefits of Long-Term Investing

The Data

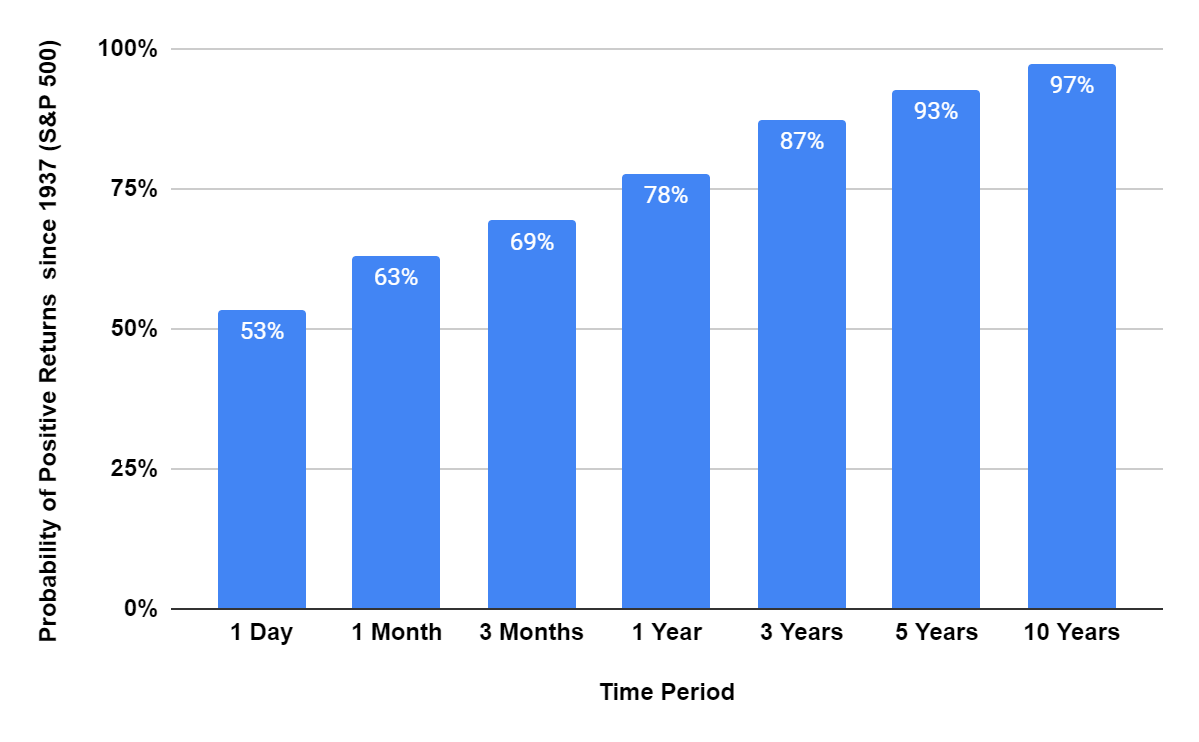

Data from the MSCI World Index shows that since 1970, each 10-year period has a 97% chance of being positive; the statistics are similar for the S&P 500. If you’d invested $10,000 in the S&P 500 in 1970 and reinvested the dividends, you’d have about $2 million today. You wouldn’t have had to work for any of it, and you could have increased this further if you’d added a bit more money each month.

Although most people seem to know this, or at least are aware that keeping a long-term focus is important, almost everyone finds it difficult to do when they see their portfolio down 10% and continuing to fall. They might try and get out of the market to avoid further losses, but as we’ll see in a bit, this is generally a terrible idea.

Compounding

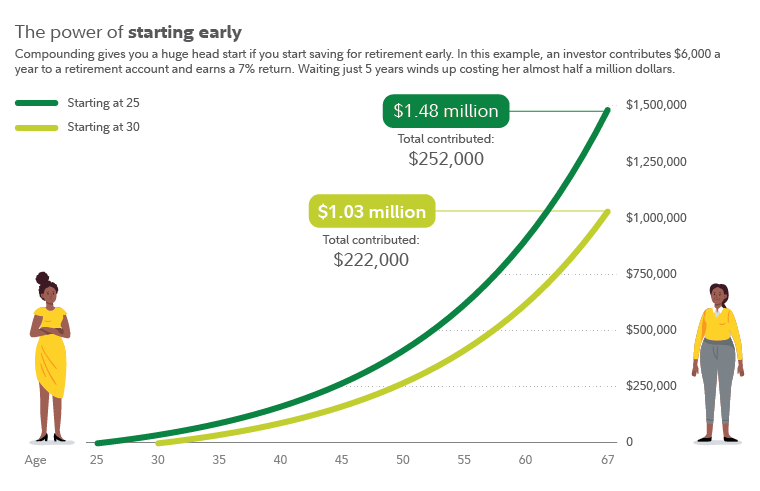

Long-term investing is also the best way to take advantage of compounding - a force Einstein reportedly called the eighth wonder of the world.

“Compounding is the eighth wonder of the world, those who understand it, earn it and those who don't, will pay it.” - Albert Einstein.

The above quote might be apocryphal but it certainly gives an idea of how powerful compounding can be. A lot of the impact comes at the end stages of growth and small changes in percentage return can have a massive impact over time.

It’s very difficult for us to comprehend the power of compounding but here’s just one quick example - if you doubled $0.01 every day for 30 days, by day 20, you’d have about $5,200. By day 30 you’d have nearly $5.4 million!

There are compound interest calculators online to help you work out how much you can save over a given time period and compound rate.

If you put in £3,000 today and grow it at 10% a year (the historic average growth of the S&P 500) whilst adding £100 a month, after 30 years you’ll have £285,000.

Just £38,000 of this will be from your deposits - £247,000 is from growth. Without adding the extra £100 a month, this falls to just £59,000.

Long-term investing relies on buying something and then not touching it again, just letting it compound over time. Historically, long-term investing has required almost no effort and has provided investors with massive returns. But what makes it so difficult?

Challenges of Long-Term Investing

“By far, the most important quality is not how much IQ you’ve got. You need a reasonable amount of intelligence, but temperament is 90% of it.” - Warren Buffet

As you can see from the quote above, intelligence isn’t the limiting factor when it comes to investing successfully. There are thousands of hedge funds around the world, and I’m sure the majority of them are managed by extremely intelligent and well-qualified people. So why do most of them underperform the market?

Fees

Perhaps it’s fees. Buffet makes another interesting point in his 2016 shareholder letter:

“A lot of very smart people set out to do better than average in securities markets. Call them active investors. Their opposites, passive investors, will by definition do about average. In aggregate their positions will more or less approximate those of an index fund.

Therefore, the balance of the universe—the active investors—must do about average as well. However, these investors will incur far greater costs. So, on balance, their aggregate results after these costs will be worse than those of the passive investors”

The fees that hedge funds charge are certainly a large part of why they underperform the markets, but if this is the reason, then why can’t most retail investors (many of which now pay near zero fees) beat the market?

Emotional and Psychological Biases

Emotional and psychological biases are known to affect any investor’s performance, regardless of intelligence. It’s important to minimize the impact they can have on your portfolio. Don’t get too excited and put too much in when things are going well, and don’t become despondent and sell early just because the market’s going down.

The biases that affect investing are well documented, I’ll briefly go through a few of the most impactful ones below 👇

Endowment Bias - The tendency to ascribe more value to items you own simply because you own them. Eg - people pay more to retain something they already have than to obtain something that does not belong to them, even when there is no cause for attachment.

Confirmation Bias - The tendency to seek information that supports a person's beliefs. This bias may lead people to focus only on information that reinforces their opinions about an investment.

Sunken-Cost Bias - Sunken-cost bias refers to a tendency for people to irrationally follow through on an activity that is not meeting their expectations. For example, people will remain invested in a stock even when they think it’s going down another 20% just because they've bought it and have already lost money investing in it.

Loss-Aversion Bias - The pain of losing is psychologically twice as powerful as the pleasure of gaining. Loss aversion refers to an individual’s tendency to prefer avoiding losses to acquiring equivalent gains.

Self-Attribution Bias - People's tendency to attribute successes to personal skills and failures to factors beyond their control.

People are much more prone to these biases than they believe and they are another big reason for poor performance when investing.

Long-Term Investing is Boring

Unfortunately, as effective as long-term investing is, it’s also quite boring.

It’s much more fun to day-trade and get instant feedback on your strategy, rather than waiting years to sell a stock and withdraw the money. However, the overwhelming majority of day traders fail to beat someone who just buys an index fund that tracks the S&P 500 and doesn’t touch their account again. The statistics online vary a lot, but most say anywhere from 99% - 70% of day traders lose money and about 95% have given up after 5 years.

Of course, if day trading works for you then great! But there’s a very high chance it won’t, even if you invest the time and energy to study it - why not just invest a little bit each month, focus on your career (assuming you enjoy it), and then make your money work for you?

Timing the Market

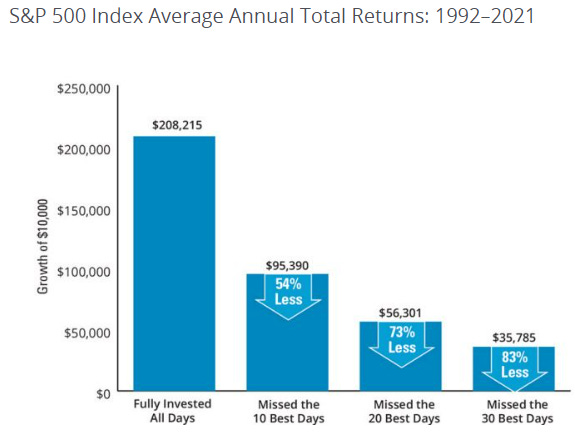

Maybe the main reason investors fail to beat the market is that they try to time it. The problems with timing the market are well documented. You might get lucky a few times, but by and large, trying to buy a stock at its lowest point and sell at its highest point just doesn’t work.

It’s much better to just invest when you can and in a company that you believe has great potential, rather than waiting until it falls to buy it - time in the market beats timing the market.

The S&P 500 has seen declines of 10% or more in 10 of the past 20 years but has still risen 300% - despite the 2000 dot-com bubble, the 2008 financial crisis, the pandemic in 2020, and the 2022 inflation issues! If you’d invested in 2000 and not touched it at all, you’d have made 300% profit and you didn’t have to work for any of it!

Trying to get out of the market when it’s falling is generally a bad idea - miss out on just 10 of the best trading days in a given decade and, as you can see below, your returns fall dramatically.

Unfortunately, many of the best days for the market come in the middle of the worst periods. It wasn’t uncommon for the market to rise 2% - 4% in a single day in the middle of the 2008 crash and the pandemic crash in 2020, despite falling overall.

The reverse also applies - miss out on the 10 worst days, and your returns go up a lot too. But since there’s no way to tell if any given day will be good or bad, it seems better to me to just remain invested all the time and ignore volatility.

Understanding cognitive biases and being aware that you’re still susceptible to them even when you know they exist is very important when it comes to investing. As is knowing that although it’s effective, long-term investing, is by its very nature, kind of boring. So now you have a basic understanding of what can affect your investment decisions, what are some strategies for successful long-term investing?

Strategies for Successful Long-Term Investing

Dollar Cost Average into the Market

Part of avoiding timing the market is just remaining invested. This can be hard when your portfolio’s down, even when you know it’s the right thing to do. But knowing that market falls are totally normal and nothing to worry about helps a lot.

If you’re unsure whether you can stick through the difficult times and keep adding money even through downturns, you could try dollar cost averaging - investing a certain amount of money each month regardless of market moves.

Dollar cost averaging is a great strategy for long-term investors, it helps avoid the pitfalls of trying to time the market and is easy to set up. Many investing platforms even provide the option to automate it so it can be done with a set amount of your salary as soon as it arrives in your bank account.

Buy ETFs

ETFs (Exchange Traded Funds) are great for long-term investors - they offer a convenient and cost-effective way to diversify your portfolio.

Think of them like a buffet of investments - you can select from a variety of options, such as stocks, bonds, or even real estate, all in one convenient package. You can also add geographic diversification to your portfolio by investing in index funds with exposure to different parts of the world.

And because ETFs typically have lower fees than other funds, they help keep your money working for you over the long run without you paying much for buying or holding them.

Investing in ETFs is especially useful if you don’t want to take the time to research individual stocks, which is a much higher risk/reward strategy. ETFs give you the option to just buy a collection of stocks you think will do well and hold them.

Start Early

As you saw before, the earlier you start, the longer you’ve got to let the compounding effect work on your investments. The difference between someone who starts investing at 25 and someone who starts at 30 can be massive by the time they both reach 60.

Try to ignore the media and the hubbub around investing. It’s mostly there to get people in and out of positions so that the exchanges make money from the spreads. The media and many prominent figures in the finance world are generally completely wrong when predicting what will happen in the short term. Focus on what you can be more sure of - the long term.

If you’re under 30 and already investing, keep it up! It will pay off massively in the future. If you’re older, the best time to start investing was when you were 18, the second best time is now!

Conclusion

Long-term investing may not be the most glamorous or exciting way to grow your wealth, but it's definitely one of the most effective.

As a retail investor, you have big advantages over larger investors. It’s easier for you to avoid a herd mentality when you don’t have clients to worry about and don’t have to compare your performance to that of others.

As Warren Buffet said above, you can match or even outperform most hedge funds by simply buying the S&P 500 and holding it through thick and thin, investing a bit more each month.

It’s always a good day to remember the words of Jack Bogle:

“Invest for the long term, and pay no attention to the foolishness that goes on in the short term in the stock market. The stock market is a giant distraction to the business of investing.”

Disclaimer

This is not financial advice. The information provided is for general informational purposes only and does not take into account your individual circumstances, financial situation, or needs. The information contained herein may not be appropriate for your specific situation and should not be relied upon without seeking advice from a licensed financial advisor. Please consult a financial professional before making any investment decision. The author and publisher shall have no liability for any loss or damage suffered by you as a result of relying on this information.