The Most Important Metric

Why free cash flow is the most important metric to look at when it comes to investing.

There are countless metrics and financial ratios that investors use to gauge the health of a company when considering investing in it. From earnings per share (EPS) to debt-to-equity ratios, each serves its purpose in evaluating different aspects of a company's financial performance. However, one metric often stands out for its ability to show a company's operational efficiency and long-term sustainability: free cash flow (FCF).

It’s what famous investor Bill Ackman believes is the most important metric when looking at the quality of a business.

Understanding Free Cash Flow

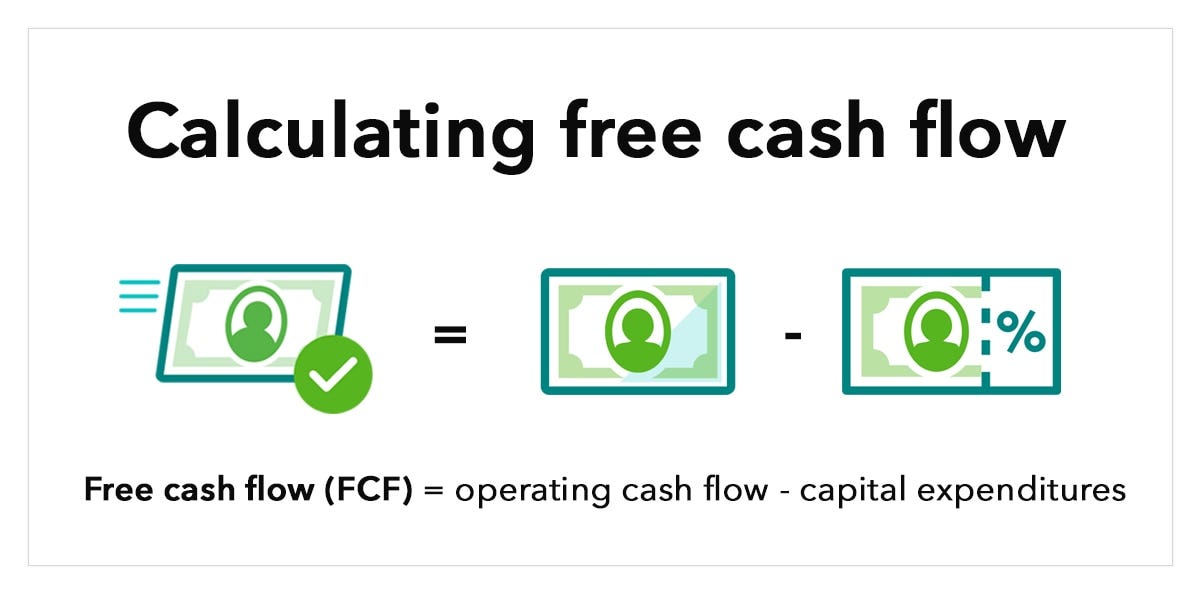

FCF represents the cash a company generates after accounting for cash outflows to support operations and maintain its assets. As with all metrics, it can be influenced by different types of accounting practices, but in general, FCF offers a clear and tangible understanding of a company's financial health.

It's calculated by subtracting capital expenditures (aka capex) from operating cash flow (a measure of the amount of cash generated by a company's normal business operations). It helps show how much cash is available for the business to invest in dividends, debt reduction, reinvestment, and growth opportunities.

Why Does FCF Matter?

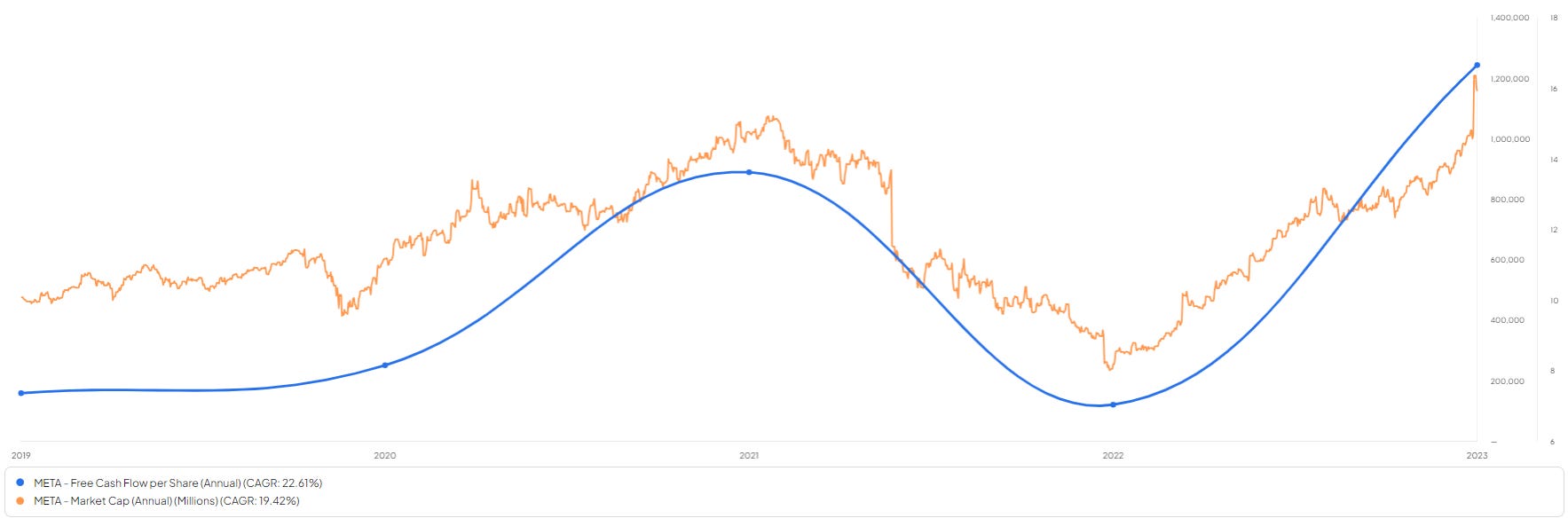

As you can see below, FCF and market cap are often closely correlated, especially in large companies. The example below is Meta, but the same trend can be seen in many businesses. It’s a critical metric for any company and its investors.

Financial Health

FCF is probably the best indicator of a company's ability to generate cash, essential for operational stability, flexibility, and growth. A company with a good FCF is better positioned to invest in product development, reduce debt, and weather economic downturns without the need to take on more liabilities.

Growth Sustainability

A high FCF means a company's growth is likely sustainable without the need for constant capital infusions. It suggests that the business is running efficiently, generating more cash than it needs to maintain and expand its operations. This self-sustaining growth is a key attribute of a solid investment.

Measure of Performance

Earnings can sometimes be misleading due to various accounting practices and non-cash items like depreciation and amortization. FCF, as a cash-based metric, often provides a more accurate and straightforward measure of a company's performance and profitability. Although this isn’t always the case, it’s often more reliable and revealing than many other accounting metrics, especially the “Community-Adjusted EBITDA” favored by Adam Neumann of WeWork.

Conclusion

While investors of course have to accept that no single metric can provide a complete picture of a company's financial health, FCF offers a clear, comprehensive view of a company's operational efficiency, financial flexibility, and growth potential.

Looking at it can help investors better identify companies that are not only surviving but thriving, capable of generating significant value over time. The relative simplicity and insight provided by FCF help make it one of the most useful and important metrics to look at when analyzing a company.

Thanks for reading 🙏

Harry