Amazon Web Services (AWS) is one of the defining businesses of our generation.

It’s been the main driver of Amazon’s profit over the past decade and thousands of start-ups and mature companies have built their products on it, including Netflix and the CIA.

Since its creation in 2006, it’s gone on to become the world’s leading cloud computing platform and now powers about 6% of the entire internet.

The Recent Past

The full history of AWS is beyond the scope of this article but in my opinion, there are two clear areas that have defined the business in the past few years - high margins and market share.

Margins

Whereas Amazon’s retail business has margins of around 2-3%, AWS’s regularly get close to 30% - without AWS, Amazon would be almost losing money.

One way AWS has managed to cut costs is through extending the lifetime of its servers - some of the ones running today are the same as it bought back in 2006. Bringing chip design in-house has also helped boost AWS’s margins and cut the costs of developing its hardware.

Even as the costs of running cloud servers has fallen, prices charged to customers have not which has also helped keep margins high.

“By integrating all of our silicon development in-house, and not relying on third parties, we can deliver silicon products on an accelerated timeline.” - Rami Sinno, director of silicon engineering at AWS.

Amazon is trying to move up the tech stack as the cloud market matures and build more software for its customers to run their own projects on in AWS.

At the start of 2023, it announced a partnership with Hugging Face, a community-based AI platform, to offer easily accessible AI models.

BMW also announced recently that it would move all its autonomous vehicle training data to AWS.

It’s long-term partnerships like these, built on top of AWS technology, which allow it to maintain its high margins whilst developing the next generation of cloud technologies.

Market Share

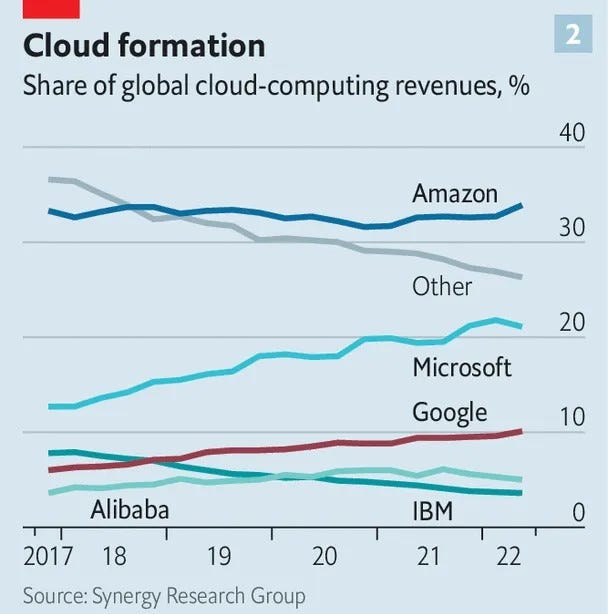

In 2022, Amazon had about a 34% share of the global cloud computing market. The top three cloud companies (AWS, Google and Microsoft) together control about 66% of the total cloud market.

The latter two are gaining slowly and are no doubt serious competitors, but AWS’s head start in the space means they’re still far ahead.

The high costs of switching cloud providers means that customers tend to stay with the one they’re at - good news for Amazon since most of them are already with AWS.

Q2 2023

Highlights from AWS’s Q2 2023 included:

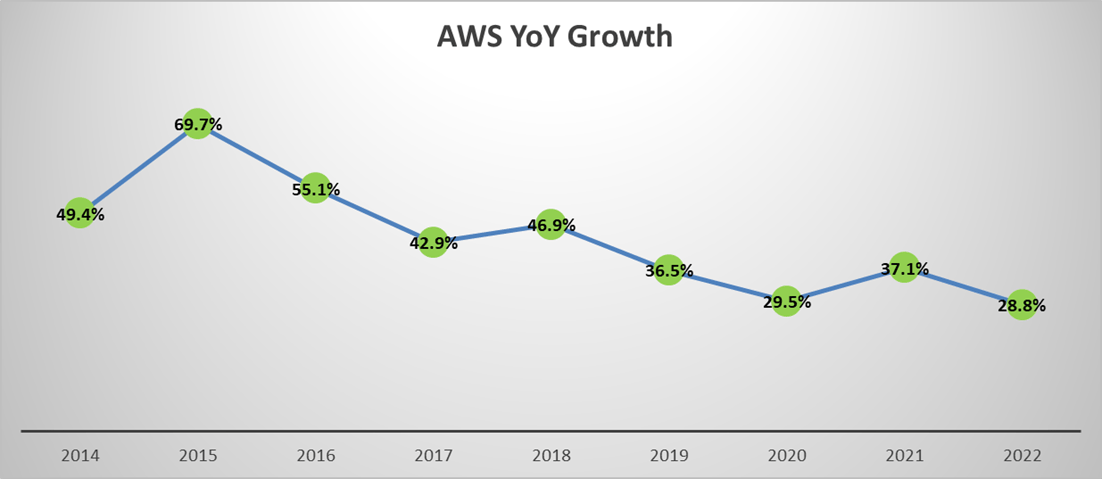

Revenue: $22.1 billion, 12% higher than Q2 2022.

Operating Profit: $5.4 billion, 5% lower than Q2 2022 but still higher than expectations.

Invested $100 million into its new Generative AI innovation Centre to match customers and experts.

Introduced Bedrock, a service that organizations can use to deploy AI models to create text and images in response to user input.

Regarding the quarter, Andy Jassy said:

“Our AWS growth stabilized as customers started shifting from cost optimization to new workload deployment, and AWS has continued to add to its meaningful leadership position in the cloud with a slew of generative AI releases that make it much easier and more cost-effective for companies to train and run models.”

The company also announced new contracts with customers like Omnicom, a global marketing and communications company, and Old Mutual, an African financial services group.

Future Growth Drivers

Growing Demand

According to Amazon CEO, Andy Jassy, 90%+ of all global IT spend is still spent on on-premise computing rather than on cloud development.

This gives AWS plenty of room for growth despite it already bringing in revenues of $80 billion in 2022.

In 2023, total spend on cloud computing is estimated by Gartner to be about $600 billion, up from $490 billion in 20233, and will likely grow to over $1 trillion by 2030.

Even if Amazon has a 20% market share by then, it’s still $200 billion in revenue each year.

All the 3 biggest cloud providers, Google, Amazon and Microsoft have a backlog of multi-year contracts reportedly worth tens of billions.

Cloud-Based AI

As previously mentioned demand for cloud-based AI products has exploded since the start of 2023, with more and more companies looking to invest in large-language models and other forms of generative AI.

Migrating workloads to the cloud is a crucial step before building most AI based products nowadays, and Amazon’s investments in the space put them in a great position to be a market leader.

Products like Amazon Bedrock, a platform to build and scale generative AI models, and Amazon Sagemaker, to build and deploy models at scale.

AWS’s Trainium chip, so called because it accelerates the training of AI models, also allows it to optimize its own hardware for the software programs built on top of it.

Amazon’s investments in AI and cloud-based development put it at the forefront of two of the most defining industries of the next decade. It’s for this reason that it’s one of the highest conviction stocks in my portfolio despite the arguably rich valuation.

Conclusion

Amazon has funded its eCommerce, advertising, and other projects using the cash generated by AWS.

By accepting lower margins in the retail business and being able to keep them high in the cloud business, it can easily compete with any eCommerce competitor.

Its advertising business has gone from strength to strength since it was created in 2012. In 2022, it made up 7.3% ($37.7 billion) of Amazon’s total revenue, up from 4.5% ($19.8 billion) in 2019.

Regardless of whether Amazon finds other industries to enter and disrupt, it’s pretty clear that AWS is going to play a key role in the company’s growth over the next decade.

Risks remain. Higher than projected development costs of the AWS platform or weaker customer cloud spending could significantly impact AWS revenues.

But the fact that former Amazon CEO Jeff Bezos made Andy Jassy, former head of AWS, the new CEO in 2021, shows just how important AWS is for the Amazon ecosystem.

If the past is anything to go by, the next decade promises to be revolutionary for AWS and Amazon as a whole. It’s an exciting time to be an Amazon shareholder.