AutoGPT Development Accelerates, Bank Reports Show Earnings Health, and Ethereum's Shanghai Upgrade Goes Ahead as Planned. Newsletter #19

AutoGPT Development

Ethereum’s Shanghai Upgrade Completed

Crypto-AI Concerns

Inflation Worries Recede Further

Healthy Bank Earnings

AutoGPT Development

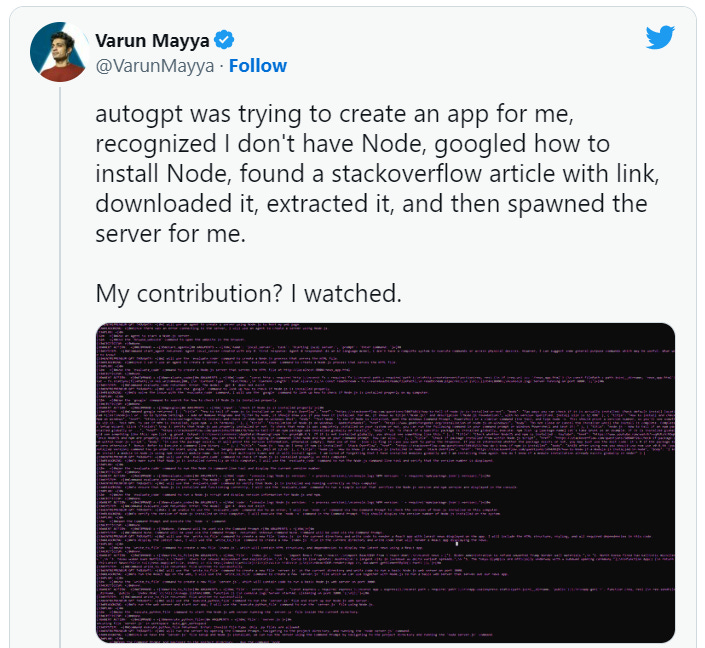

Development of AutoGPT, an open-source experiment to try and make GPT4 autonomous (sounds like a great idea), is continuing at an astonishing rate.

The idea is that a user can give AutoGPT a task and the program will continue to work on it without anyone even being present. It’s self-correcting, has memory, can browse the entire web in a few seconds, and read/write/edit data if needed.

As with any technology though, it can be used for bad or good.

One nightmare scenario is bad actors having it work 24/7 on putting out misinformation or working to get access to someone’s private information. Of course, there’s also positives too, a huge amount of boring work that people do can be automated away easily with technology like this.

If AutoGPT does actually become as good as the creators claim it will, it poses a threat to journalists, software engineers, and a whole host of white-collar work. It doesn’t seem like there’s too long to wait till we’re close to fully automating the majority of office jobs.

The Github repo was created just 2 weeks ago but already has over 11,000 forks being worked on, and with user-friendly interfaces now being developed, it’s perhaps only a matter of time until this becomes as popular and as widely used as ChatGPT.

Ethereum’s Shanghai Upgrade Goes Ahead

Ethereum’s Shanghai hard fork (aka Shapella) has been completed. Users who had staked their Ether to secure and validate transactions on the blockchain can now withdraw it.

The hard-fork (essentially upgrading the blockchain by splitting off a new one) is seen by many as a historic milestone in the quest towards its ultimate goal of becoming the world’s computer and marks its finalization as a full proof of stake protocol.

Vitalik Buterin, Ethereum creator and leader, believes the hardest part of the Ethereum roadmap is now completed saying:

“We're in a stage where the hardest and fastest parts of the Ethereum protocol's transition are basically over. Very significant things still need to be done, but those very significant things can be safely done at a slower pace.”

Prior to the upgrade, market analysts held differing views on how Ethereum's price would react. Some anticipated a fall because of selling pressure due to the unstaking of the Eth, while others believed there would be minimal impact or even a price increase due to increased demand after the upgrade.

In the end, the latter group was right. Eth shot up 5% in the 24 hours after the upgrade, rising above $2,000 for the first time since May 2022, and as of Sunday evening, sits at $2,100.

Crypto - AI Concerns

With the recent boom and excitement around AI, and the notoriously opaque nature of the crypto world, perhaps it was inevitable that the two would eventually meet.

CryptoGPT, a crypto project launched at the start of March, claims to be a crypto platform that lets users monetize their own data for use in AI products, but is it simply a scam?

There are endless red flags around the project, including the role and history of its founders and management, endless use of buzzwords, and the fact that the market-maker for the project, DWF Labs, is also the primary investor.

In fact, the company also claims to have raised $10 million at a $250 million valuation. But in actuality, DWF Labs has so far only invested $420,000 of the supposed $10 million so far. Make of that what you will…

It’s not the only coin to have merged in the crypto-AI space however. Other notable coins include ElonGPT, Artificial Liquid Intelligence (ALI), and SingularityNet (AGIX).

The hype around AI since the start of the year has exploded and it seems many scammers have seen an opportunity to cash in. This is unlikely to be the last we hear of the two combining together, but I wonder how long it’ll be until there’s actually a useful application?

Inflation Concerns Recede

Data out of the US last week raised hopes that the Fed would slow its interest rate rises in the coming months.

Producer Price Index (PPI) data showed that inflation continued its downward slide with prices increasing just 2.7% in March, the lowest level since January 2021. Producer prices actually fell on a monthly basis by 0.5%, driven by falling energy prices.

Core inflation, which excludes volatile food and energy prices, also fell in March. and although it was just by 0.1%, the fall still marks the first drop in nearly three years.

Inflation’s cooled sharply since the 11.2% we saw in June 2022.

In other US news, jobless claims are on the rise. Analysts believe it’s starting to look a bit worrying given that unemployment is an indicator of an upcoming recession.

“We expect the bite from the Fed’s previous rate hikes will further reduce business and consumer demand, pushing producer price inflation lower throughout the rest of the year″ - Oxford Economics research note.

But at the moment, most seem split on whether the US will eventually enter a recession or not. It could become more clear in the next few weeks as more data is released.

Healthy Bank Earnings

Bank stocks jumped last Friday despite all three major US indices falling. Citigroup, JPMorgan, and Wells Fargo all beat earnings expectations.

They reaped windfalls from higher interest rates and brushed off the regional banking crisis caused by the collapse of Silicon Valley Bank. These bank earnings were the first since the bank's collapse last month.

Wells Fargo's profits grew and briefly caused their shares to rise by up to 2.1%, before closing flat. Sales increased 18% to $30.7 billion during the first three months of the year. But deposits fell slightly, down 7% from last year.

JPMorgan Chase's net income increased by 52% YoY in the first quarter, gaining $37 billion in deposits after SVB's collapse. The bank exceeded analysts' quarterly estimates by reporting record revenue, resulting in a stock jump of about 7%

Citigroup's profits in the first quarter were driven by strong consumer spending and corporate activity, resulting in net income of $4.6 billion, which also exceeded analysts' forecasts. Citi's planned sales, including a consumer banking business based in India, further boosted profits.

"The storm clouds that we have been monitoring for the past year remain on the horizon, and the banking industry turmoil adds to these risks" - Jamie Dimon, JPMorgan CEO.

All three said they saw signs of a coming economic slowdown and are building up cash reserves as fears of a recession remain.

Promising to see that Shanghai didn’t create downward pressure on the ETH price. Looks like we are starting to see the offshoots of the next bull run with BTC and ETH leading the charge.