Silicon Valley Bank’s downfall teed up a signature play by the Federal Deposit Insurance Corporation (FDIC), the federal agency responsible for backing up bank deposits (up to $250,000).

North Carolina-based First Citizens Bank agreed to take on $60 billion of SVB’s open loans in exchange for the FDIC reimbursing them up to 50% if over $5 billion of the loans end up as losses.

This is not the first time the FDIC has had this deal with First Citizens — more like 9 prior times on $8 billion of loans.

U.S. banks and lenders frequently benefit from these loss-share agreements with the FDIC. First used in the 1990s, these deals incentivized banks to take on loans and mortgages from failed banks. They became especially useful in the wake of the 2008 financial crisis as hundreds of banks went under, leading to a vast number of underwater mortgages.

In the 5-year span from 2008 to 2013, 590 such agreements covered $216 billion in assets from over 300 failed banks!

As a result, banks become larger and more powerful. Since the 2010s, First Citizen has become a more prominent regional lender and is now one of the top 20 largest lenders after its latest loss-share agreement.

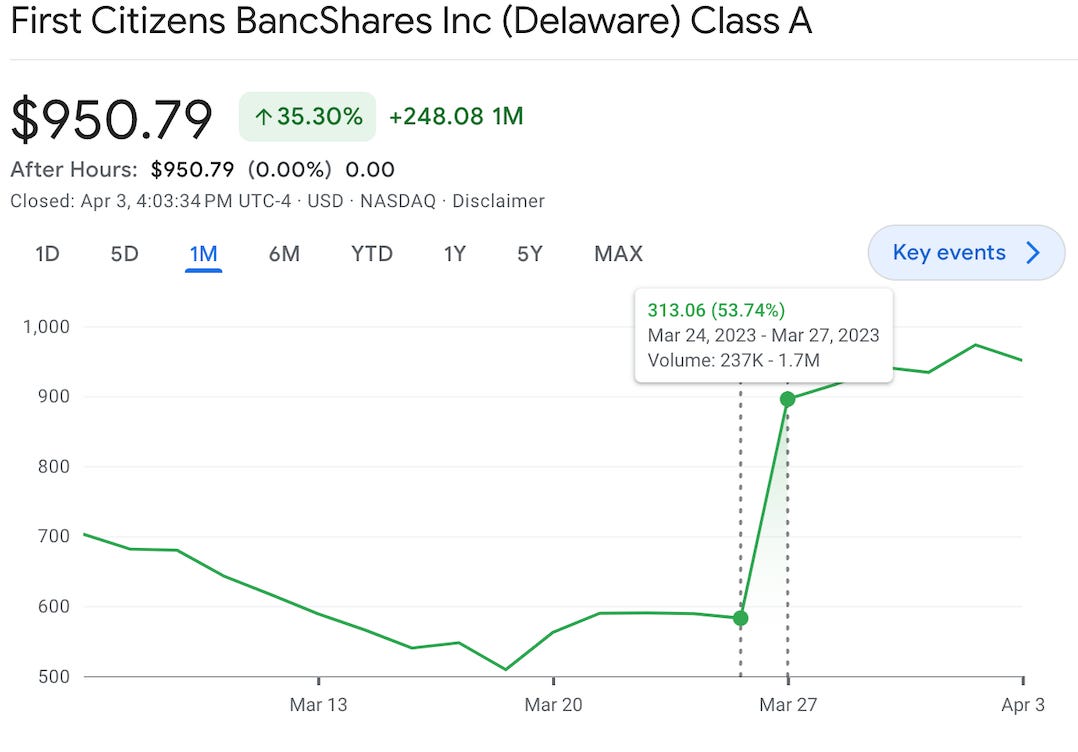

When news of the agreement broke, First Citizen’s stock price surged 50% in a single day — greatly increasing the company’s market value and its executives’ compensation.

In a banking crisis, the bankers and their shareholders ultimately win out. But what about the FDIC? The FDIC believes it wins too, as it estimates savings of $41B+ from those 590 loss-share agreements during the Great Recession.

The FDIC contends that banks have the local expertise to take care of mortgages/loans in their area. It’s also been noted that the longer the FDIC holds an asset, the more it falls in value — harmful to its resale.

Our Take: Because the FDIC’s loss-share agreements are usually offered only to larger banks with the capacity for huge volumes of loans, these banks become “too big to fail” as their market power and footprint vastly increase.

As a result, smaller banks find it harder to compete within their locales — leading to more concentration in the banking industry by reinforcing the oligopoly power of the Big 4 banks (Wells Fargo, JP Morgan, Bank of America, Citigroup). Unfortunately, this leads to fewer options for small businesses and regular bank customers, like you and me.

Loan-share agreements reward the management and shareholders of banks that receive them, while the FDIC (a public agency) is left to assume a large portion, if not the majority of the downside risk. In essence, while the government accepts some of the downside, the banks and their owners receive the upside.

Hey there! It’s the Finance Futurists. If you enjoyed our collab, subscribe to our newsletter, to get the latest on the economy, tech, and world news every Wednesday while building your personal finance toolkit.